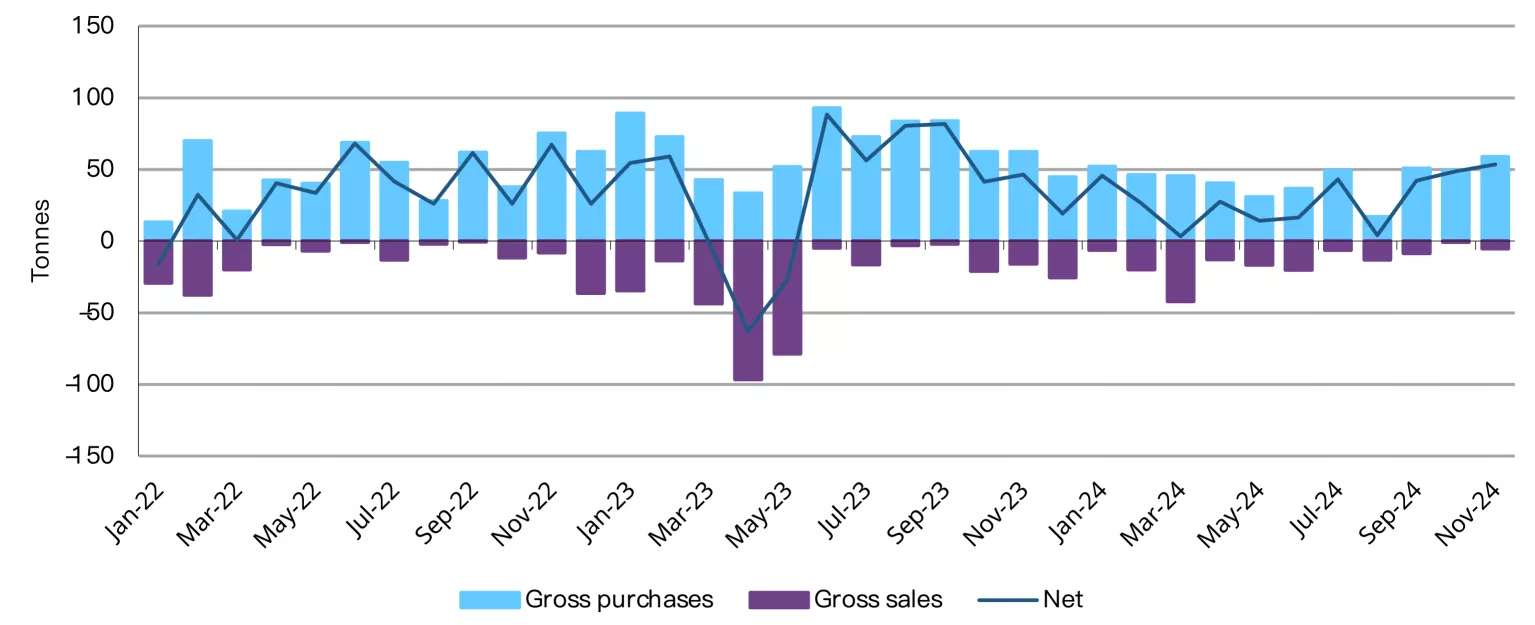

Central Banks Boost Gold Reserves in November

In November 2024, global central banks demonstrated a strong commitment to gold as a secure asset. According to the World Gold Council (WGC), these institutions collectively added 53 tonnes of gold to their reserves. This trend highlights the increasing preference for gold amidst ongoing global economic uncertainties. Notably, India emerged as a significant player in the gold market, purchasing 73 tonnes of gold year-to-date, making it the second-largest buyer of 2024. Poland led the way, with the National Bank of Poland (NBP) being the largest buyer in November.

Poland Leads Gold Purchases

The National Bank of Poland made headlines by increasing its gold reserves by 21 tonnes in November, bringing its total to 448 tonnes. This move reflects Poland’s strategic aim to bolster its gold holdings, which now account for nearly 18 percent of its total reserves. The NBP has set a target of 20 percent for gold in its reserves, indicating a clear commitment to increasing its gold assets. With year-to-date purchases reaching 90 tonnes, Poland has solidified its position as the top gold buyer of 2024.

The NBP’s actions are part of a broader trend among central banks to diversify their reserves. As global economic conditions remain volatile, many countries are turning to gold as a hedge against inflation and currency fluctuations. Poland’s proactive approach to gold acquisition underscores the importance of this precious metal in maintaining financial stability. The NBP’s strategy not only enhances its reserve composition but also signals confidence in gold’s long-term value.

India’s Growing Gold Reserves

India’s Reserve Bank has also been active in the gold market, adding 8 tonnes in November alone. This brings India’s total gold reserves to 876 tonnes, making it the second-largest buyer of the year after Poland. The sustained purchasing trend reflects India’s ongoing strategy to strengthen its gold holdings. With a year-to-date total of 73 tonnes, India is positioning itself as a key player in the global gold market.

Gold has long been an essential asset for India, both culturally and economically. The country has a deep-rooted affinity for gold, which is often seen as a symbol of wealth and prosperity. In recent years, the Reserve Bank of India has recognized the importance of gold in diversifying its reserves. This strategy not only helps mitigate risks associated with currency fluctuations but also enhances the country’s financial security.

As global uncertainties continue to rise, India’s commitment to gold acquisition is likely to persist. The Reserve Bank’s actions reflect a broader trend among central banks to prioritize gold as a stable asset in their portfolios.

Other Notable Central Bank Activities

Several other central banks also made significant moves in the gold market in November. The Central Bank of Uzbekistan resumed its gold purchases after a hiatus, adding 9 tonnes to its reserves. This brings Uzbekistan’s total holdings to 382 tonnes, with year-to-date net purchases of 11 tonnes. Similarly, the National Bank of Kazakhstan added 5 tonnes, reversing its status to a net purchaser for the year.

The People’s Bank of China (PBoC) resumed gold buying after a six-month pause, adding 5 tonnes to its total holdings of 2,264 tonnes. This represents 5 percent of China’s total reserves. The Central Bank of Jordan also increased its holdings by 4 tonnes, marking its first addition since July. Meanwhile, the Central Bank of Turkey added 3 tonnes as part of its liquidity management efforts.

In contrast, some central banks reduced their gold holdings. The Monetary Authority of Singapore was the largest seller, reducing its reserves by 5 tonnes. Additionally, the Bank of Finland announced a significant reduction in December, selling about 10 percent of its gold holdings. This brought its reserves to 44 tonnes, the lowest level since 1984, as part of a strategy to manage exchange rate risks.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.

Follow Us on Twitter, Instagram, Facebook, & LinkedIn