Strategies for Achieving Solid Returns with Reduced Risk in Multi-Asset Investments

Investors seeking stable returns with reduced risk may find multi-asset allocation funds to be a compelling option. These funds, which diversify investments across equity, debt, and commodities, have demonstrated impressive performance, particularly in volatile market conditions. Over the past three years, these funds have achieved nearly 17% compounded annual returns, significantly outpacing the Sensex, which recorded a CAGR of 15.05%. Notably, much of the success of these funds can be attributed to their exposure to gold and silver, which have seen gains exceeding 22%.

Understanding Multi-Asset Allocation Funds

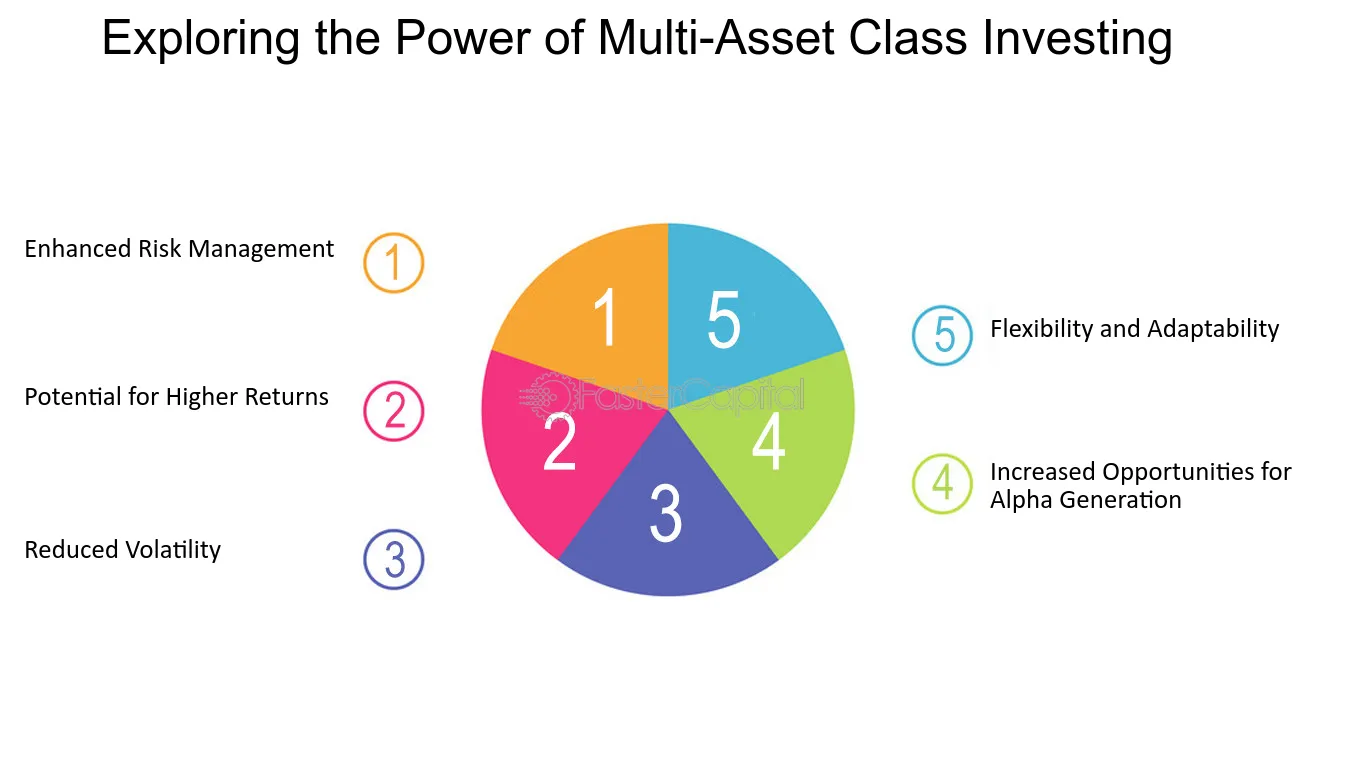

Multi-asset allocation funds are designed to invest in at least three different asset classes, ensuring a minimum allocation of 10% to each. This diversification strategy helps mitigate risks associated with market volatility. In recent years, as asset prices fluctuated, these funds have provided a robust alternative for investors. The ability to blend various asset types allows for a more balanced portfolio, which can withstand market shocks while still capitalizing on potential growth opportunities.

The performance of these funds has been particularly noteworthy. For instance, while the Sensex has shown a CAGR of 15.05% over the past three years, multi-asset allocation funds have outperformed this benchmark with returns nearing 17%. This performance highlights the effectiveness of diversification in achieving higher returns with lower risk. Investors are increasingly recognizing the value of these funds as a means to navigate uncertain economic landscapes.

Investment Performance and Returns

The investment landscape for multi-asset allocation funds has been favorable, especially when compared to traditional equity investments. Recent data indicates that these funds have delivered impressive returns across various time frames. For example, in the past year, multi-asset allocation funds yielded returns of 5.57%, while the Sensex only managed 3.81%. Over three years, the returns for multi-asset allocation funds reached 16.96%, compared to the Sensex’s 15.05%.

Moreover, the performance of individual asset classes within these funds has also been noteworthy. Gold, for instance, has provided a staggering 30.98% return over the past year, significantly contributing to the overall success of multi-asset allocation funds. This trend underscores the importance of including commodities like gold and silver in investment strategies, particularly during periods of market instability.

Tax Advantages of Multi-Asset Allocation Funds

One of the significant benefits of investing in multi-asset allocation funds is the favorable tax treatment associated with them. Gains from gold and silver ETFs, as well as debt funds, are typically taxed at the investor’s slab rate. However, when these assets are included in a multi-asset allocation fund that invests at least 65% in domestic equities, the tax implications are considerably more favorable.

According to experts, if a fund maintains this equity threshold, it qualifies as an equity scheme for tax purposes. This classification allows investors to enjoy long-term capital gains of up to Rs 1.25 lakh per year without incurring taxes. Beyond this threshold, gains are taxed at a reduced rate of 12.5%. Additionally, short-term gains are taxed at 20%, and the holding period for long-term gains is just one year. This tax efficiency makes multi-asset allocation funds an attractive option for investors looking to optimize their returns.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.