ITR Filing: How to Use Rent Receipts for HRA Tax Reduction

House Rent Allowance (HRA) is a popular tax-saving benefit for salaried individuals, but recent scrutiny by tax authorities reveals that even well-documented claims can be rejected. Tax officers are increasingly questioning the legitimacy of transactions, especially when they involve payments to close family members. To successfully claim HRA exemption under Section 10(13A) of the Income Tax Act, employees must provide appropriate documentation, including rent receipts and agreements, to their employers. However, these documents may not be enough to guarantee approval during tax assessments.

Understanding HRA Exemption Claims

To qualify for HRA exemption, salaried individuals must receive an HRA component in their salary. They are required to submit relevant documents, such as rent receipts, rental agreements, and landlord details, to their employer. While these documents are not mandatory when filing the Income Tax Return (ITR), tax authorities can request them during scrutiny. The exemption amount is determined by the lowest of three calculations: the actual HRA received, 50% of the basic salary plus dearness allowance (DA) for those living in metropolitan areas (40% for non-metros), or the rent paid minus 10% of the salary (basic + DA). Despite having the necessary paperwork, taxpayers must be cautious, as discrepancies can lead to rejection.

Red Flags in HRA Claims

The Income Tax Department has flagged numerous cases where rent payments were made to close relatives, such as spouses or parents, raising concerns about the authenticity of these arrangements. Experts emphasize that proper documentation alone does not guarantee approval. For instance, one case involved an employee who submitted rent receipts for payments made to his wife. The claim was denied because the wife had no other income source, leading tax authorities to deem the transaction non-genuine. Similarly, another taxpayer claimed HRA for rent paid to her mother, but the arrangement was rejected due to a lack of verifiable financial transactions and discrepancies in documentation.

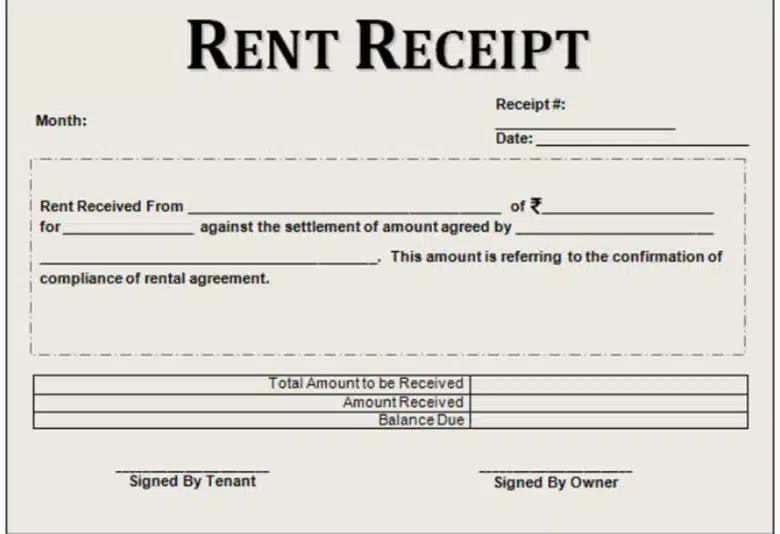

Importance of Proper Documentation

Tax experts stress that maintaining proper documentation is crucial for substantiating HRA claims. Rent receipts must be accompanied by a valid rental agreement, the landlord’s PAN if the rent exceeds Rs 1 lakh annually, and proof of rent payments through banking channels. Cash payments without corresponding bank withdrawals can raise red flags. Additionally, inconsistencies between rent-related documents and other financial statements, such as Form 16 or Form 26AS, can increase the likelihood of rejection. Claims made while owning a self-occupied home in the same city can also invite scrutiny, particularly if there is no reasonable explanation for renting.

Ensuring Compliance with Tax Regulations

Taxpayers must ensure that their HRA claims are backed by credible financial transactions, not just paperwork. The Assessing Officer (AO) has the authority to seek clarifications and reject claims if supporting evidence appears unreliable. Experts recommend that taxpayers maintain a valid rent agreement, provide the landlord’s PAN, and ensure that rent payments are made through bank transfers. Other potential issues include inflated rent amounts, the use of generic or duplicate receipts, and inconsistencies in addresses across various documents. By adhering to these guidelines, salaried individuals can better navigate the complexities of HRA claims and avoid potential rejections.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.

Follow Us on Twitter, Instagram, Facebook, & LinkedIn