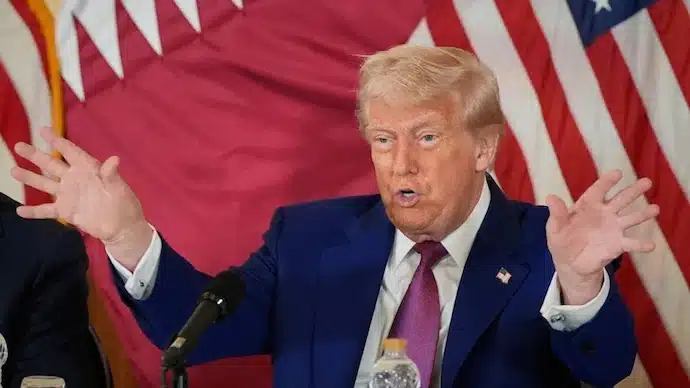

Volatility in Donald Trump’s Trade Policy Impacts Business Confidence

In a recent analysis by Nomura Research Institute, rising trade tariff uncertainties under the Trump administration are causing businesses to reconsider their investment strategies. The report highlights that this unpredictability could lead to a global economic slowdown, as companies are likely to delay or scale back new investments. With investor sentiment already dampened, the potential for prolonged repercussions on global markets is a growing concern.

Impact of Tariff Uncertainty on Investments

The Nomura report emphasizes that the erratic nature of U.S. trade policies is creating a climate of uncertainty that discourages long-term investments. Businesses are increasingly cautious, opting to shelve or reduce their investment plans as concerns over tariffs persist. This hesitance could trigger a broader economic slowdown, as reduced capital flows may stifle growth across various sectors. The analysis categorizes the Trump administration’s tariff strategy into three distinct phases: shock, backlash, and tactical recalibration. Each phase reflects the ongoing volatility and systemic risks associated with unpredictable policymaking.

Market Reactions to Tariff Announcements

Following the announcement of steep reciprocal tariffs on April 2, financial markets experienced a notable “triple decline.” This phenomenon saw simultaneous drops in U.S. equities, Treasury bonds, and the dollar, indicating that investors were reacting negatively to the tariff news. The report suggests that this decline may have prompted some investors to sell off dollar-denominated assets, further exacerbating market instability. The volatility in trade costs and the looming threat of abrupt policy changes are significant factors that deter organizations from committing to long-term investments, potentially leading to a prolonged period of economic uncertainty.

Geopolitical Complexities and Future Outlook

The geopolitical landscape under President Trump adds another layer of complexity to the economic situation. His attempts to isolate China through diplomatic outreach to North Korea and Russia have not yielded the desired results, as China has responded by strengthening its regional alliances with economic incentives. Looking ahead, the Nomura report suggests that as tariffs become a contentious political issue, there may be a shift in focus toward addressing trade imbalances through currency adjustments. Such a pivot could introduce new instabilities into global foreign exchange markets, with some currencies, like the Taiwanese dollar, already showing significant appreciation in anticipation of U.S. pressure.

Long-Term Economic Implications

The overall outlook presented by Nomura is cautious, indicating that global economic and financial conditions may remain strained if policy uncertainty continues. As businesses adapt to extreme tariff scenarios in their strategic planning, the potential for restricted capital flows could persist for years. The report underscores the importance of stabilizing trade relations and reducing uncertainty to foster a more favorable investment climate. Without significant changes in policy direction, the risk of a global economic slowdown looms large, affecting markets and economies worldwide.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.

Follow Us on Twitter, Instagram, Facebook, & LinkedIn