Valuation Concerns Impact Defence Stocks: Future Outlook

Defence sector stocks faced a downturn on Thursday as investors opted to take profits after a significant rally over the past three months. The Nifty India Defence Index fell by 2%, underperforming the broader Nifty, which saw a decline of 0.5%. Out of the 18 stocks listed on the defence index, 16 ended the day in negative territory, with Bharat Dynamics experiencing the steepest drop of 4.8%. Analysts attribute this correction to overvaluation concerns and a cooling of geopolitical tensions.

Market Performance and Key Losers

The Nifty India Defence Index’s decline was marked by notable losses among its constituents. Bharat Dynamics, which saw a drop to Rs 1,893, was negatively impacted after Motilal Oswal initiated coverage with a ‘neutral’ rating and a target price of Rs 1,900. Analysts from Motilal Oswal expressed a cautious outlook, highlighting the company’s solid business model but suggesting that current valuations may limit upside potential. Other significant decliners included Solar Industries, down 3.3%, and Zen Technologies, which fell by 2.9%. Additionally, Data Patterns, Astra Microwave, and Garden Reach Shipbuilders each recorded losses exceeding 2.5%. Hindustan Aeronautics decreased by 1.9%, while BEML and Paras Defence & Space Technologies both dropped by 1.4%.

Reasons Behind the Correction

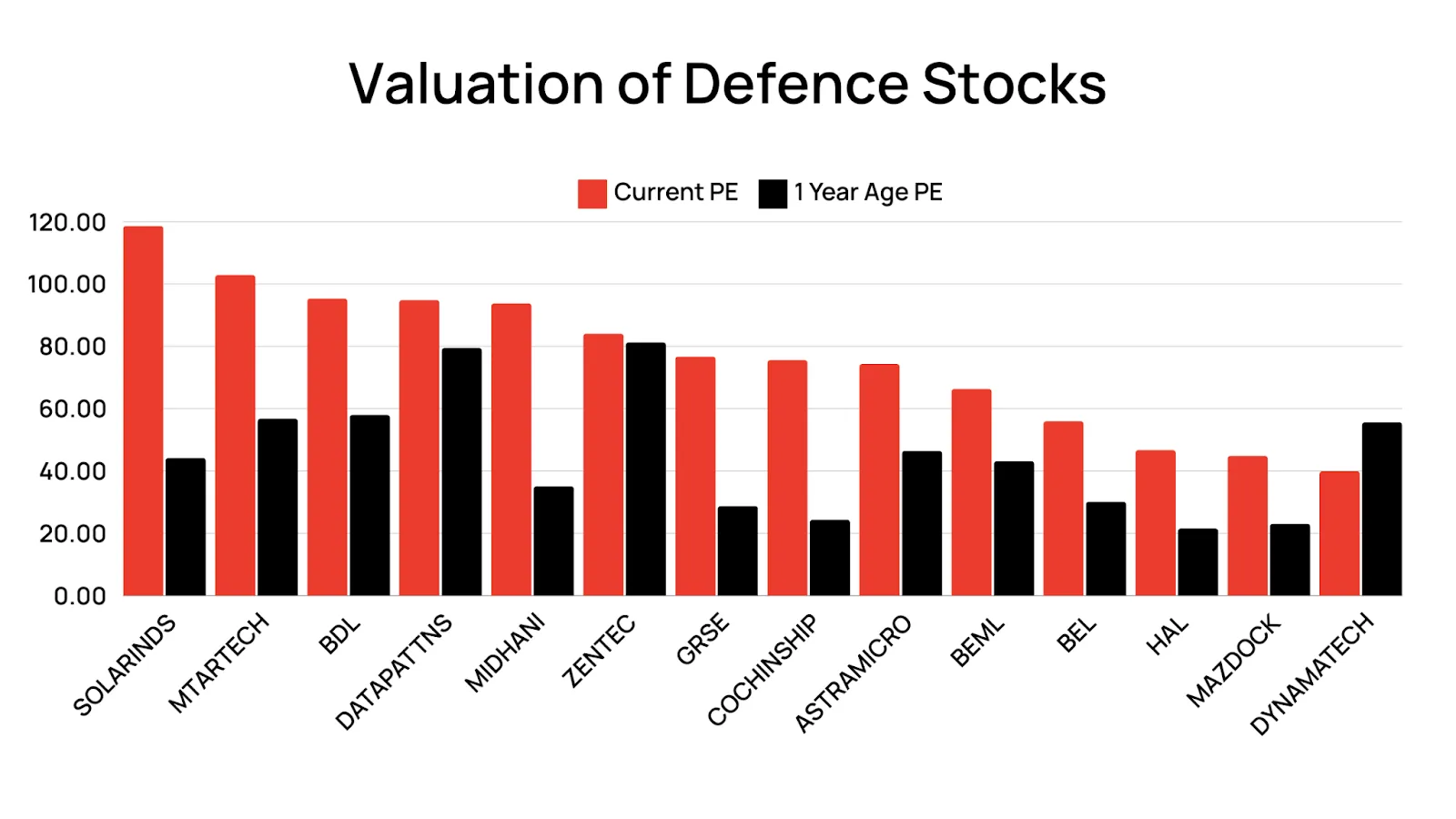

Analysts have pointed to stretched valuations and easing geopolitical tensions as primary factors behind the recent correction in defence stocks. Pranay Aggarwal, CEO of Stoxkart, noted that the profit booking was expected after the substantial rally in defence stocks, which had surged by 42.2% over the past three months. This performance significantly outpaced the broader Nifty index, which gained only 13.2% during the same period. Concerns have arisen regarding high price-to-earnings multiples, with some defence stocks trading at nearly 60 times earnings, well above historical averages. Ashwini Shami, a portfolio manager at OmniScience Capital, emphasized that unless companies continue to deliver robust growth, further declines could be anticipated due to these premium valuations.

Outlook and Investment Strategies

Despite the recent downturn, some fund managers maintain a positive outlook on the long-term growth potential of the defence sector. Bhalchandra Shinde, an associate fund manager at Motilal Oswal AMC, highlighted that certain companies could see order inflows increase by 70–80%, which may justify current valuations, especially with significant export opportunities on the horizon. Shinde recommended a buy-on-dips strategy for investors, suggesting that the defence segment may experience sideways trading in the coming months. He noted that the lack of major events in the second half of the year could lead to a stable market environment, as most orders are typically secured in the first quarter of the year.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.