India’s economy is expected to contract by 10.3%, says IMF

The International Monetary Fund (IMF) logo. Source: Deccan Herald

While still reeling under tremendous impact from COVID-19, the Indian economy is expected to contract by 10.3 % in the year 2020 as per World Economic Outlook published by IMF this month. World Output is also projected to contract by 4.4% for this year.

It is based on World Economic Outlook October 2020 report titled, “A Long and Difficult Ascent” published by IMF.

The recent projection for India is downgrade from -5.8% which was estimated by IMF in June 2020. It is also projecting that growth for India will rebound in 2021 with expected growth of 8.8% in comparison to June estimate of 2.8%.

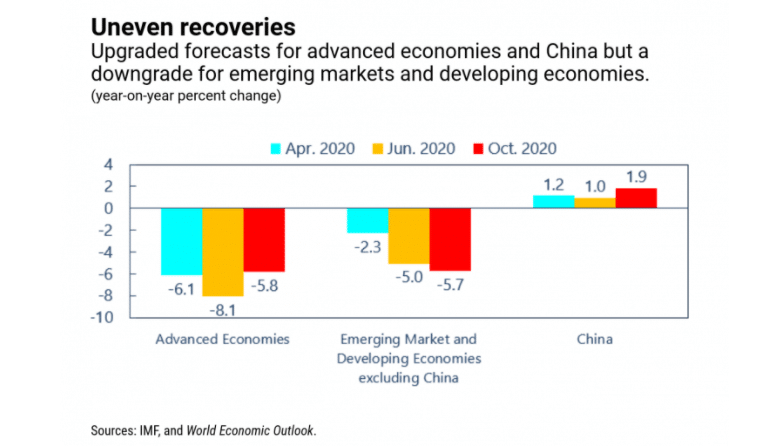

China is expected to grow by 1.9% and 8.2% in 2020 and 2021 respectively; whereas the US economy is expected to contract by 4.3% in 2020 and grow by 3.1% in the year 2021. Euro Area is expected to contract by 8.3% in 2020 and grow by 5.2% in the next year.

Impact of Global Poverty

The great ongoing pandemic deprived daily wage labor of their income due to the mobility restrictions imposed around. Among them, migrant workers who live far from home had even less recourse to traditional support networks. As a result, close to 90 million people could fall below the $1.90 a day income threshold of extreme deprivation this year. In addition, school closures during the pandemic pose a significant new challenge that could set back human capital accumulation severely. It is also expected that the pandemic will reverse the progress made since the 1990s in reducing global poverty and will increase inequality.

Further Actions

Ms Gopinath in a blog stated that the considerable global fiscal support of close to $12 trillion and the extensive rate cuts, liquidity injections, and asset purchases by central banks helped saved lives and livelihoods and prevented a financial catastrophe.

She said that there is still much that needs to be done to ensure a sustained recovery. First, greater international collaboration is needed to end this health crisis. Tremendous progress is being made in developing tests, treatments and vaccines, but only if countries work closely together will there be enough production and widespread distribution to all parts of the world. We estimate that if medical solutions can be made available faster and more widely relative to our baseline, it could lead to a cumulative increase in global income of almost $9 trillion by end-2025, raising incomes in all countries and reducing income divergence.

Second, to the extent possible, policies must aggressively focus on limiting persistent economic damage from this crisis. Governments should continue to provide income support through well targeted cash transfers, wage subsidies, and unemployment insurance. To prevent large scale bankruptcies and ensure workers can return to productive jobs, vulnerable but viable firms should continue to receive support—wherever possible—through tax deferrals, moratoria on debt service, and equity-like injections.

Over time, as the recovery strengthens, policies should shift to facilitating reallocation of workers from sectors likely to shrink on a long-term basis (travel) to growing sectors (e-commerce). Workers should be supported through this adjustment with income transfers, retraining, and reskilling. Supporting reallocation will also require steps to speed up bankruptcy procedures and resolution mechanisms to efficiently tackle firm insolvencies. A public green infrastructure investment push in times of low interest rates and high uncertainty can significantly increase jobs and accelerate the recovery, while also serving as an initial big step towards reducing carbon emissions.

Emerging market and developing economies are having to manage this crisis with fewer resources, as many are constrained by elevated debt and higher borrowing costs. These economies will need to prioritize critical spending for health and transfers to the poor and ensure maximum efficiency. They will also need continued support in the form of international grants and concessional financing, and debt relief in some cases. Where debt is unsustainable it should be restructured sooner than later to free up finances to deal with this crisis.

Lastly, policies should be designed with an eye toward placing economies on paths of stronger, equitable, and sustainable growth. The global easing of monetary policy, while essential for the recovery, should be complemented with measures to prevent build-up of financial risks over the medium term, and central bank independence should be safeguarded at all costs. Needed fiscal spending and the output collapse have driven global sovereign debt levels to a record 100 percent of global GDP. While low interest rates alongside the projected rebound in growth in 2021 will stabilize debt levels in many countries, all will benefit from a medium-term fiscal framework to give confidence that debt remains sustainable. In the future, governments will likely need to raise the progressivity of their taxes while ensuring that corporations pay their fair share of taxes, alongside eliminating wasteful spending.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.

Follow Us on Twitter, Instagram, Facebook, & LinkedIn