Impact of GST 2.0 on Travel: Premium Flights Face Tax Increases, Will Rail Passengers See Higher Costs?

As the Goods and Services Tax (GST) Council recently approved a new two-tier tax structure of 5% and 18% for various goods and services, travelers are left wondering how this will impact their travel expenses. The changes, set to take effect on September 22, 2025, will see an increase in GST for premium air travel, while economy class fares remain unaffected. Meanwhile, train passengers can breathe a sigh of relief as the GST on AC and premium coach tickets will remain unchanged.

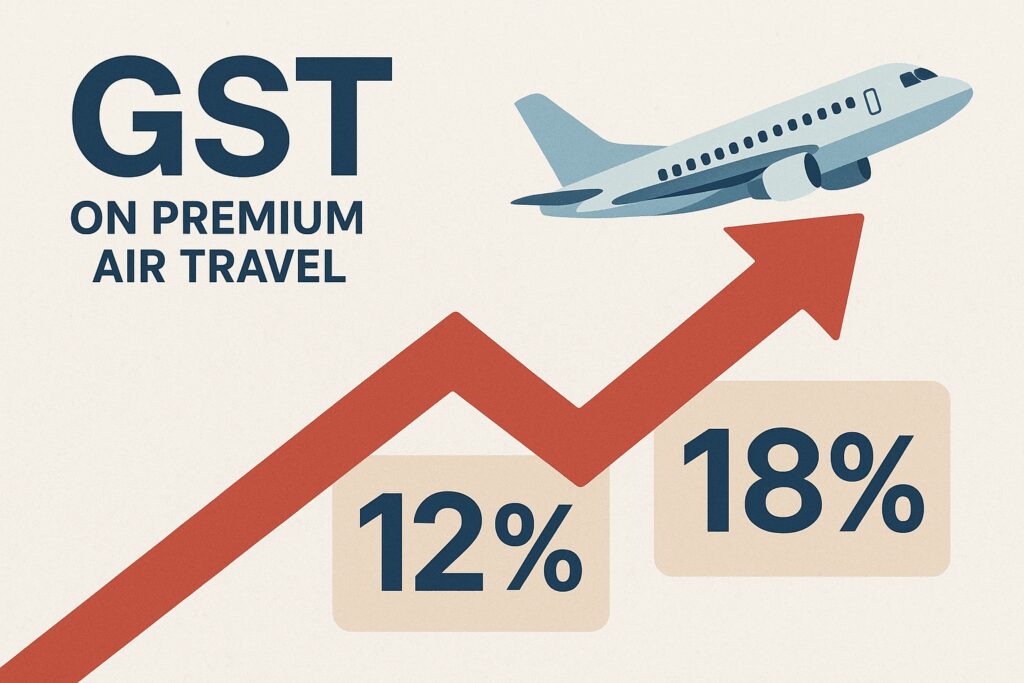

Impact on Air Travel Costs

Under the revised GST structure, the tax on premium economy, business, and first-class air tickets will rise from 12% to 18%. This change means that travelers opting for these higher classes will face increased fares. In contrast, economy class passengers will continue to benefit from a lower GST rate of 5%. According to Prabhat Ranjan, a senior director at Nexdigm, this adjustment will significantly affect those flying in classes other than economy, as they will now incur a higher GST component in their ticket prices. The new rates are expected to take effect from September 22, 2025, prompting travelers to consider booking their flights before this date to avoid the increased costs.

Train Travel Remains Unchanged

In a positive development for train travelers, the GST on AC and premium coach tickets will remain at 5%, unchanged from the current rate. This decision alleviates concerns that the new GST structure would lead to higher costs for train travel. Non-AC train travel, including Sleeper and 2S classes, will also continue to be exempt from GST, maintaining a nil-rated status even after the new rates come into effect. Ranjan confirmed that the existing 5% GST rate for AC classes, including 3AC, 2AC, 1AC, AC Chair Car, and Executive Chair Car, will persist post-September 22, 2025.

Clarifications on Transition Rules

Bimal Jain, a chartered accountant and founder of A2Z Taxcorp LLP, provided clarity on the transition rules for air travel. He explained that for tickets booked before September 22, 2025, the applicable GST rate will remain at 12% if both the invoice date and payment date occur prior to the rate change. This means that travelers who book and pay for their tickets on the same day before the deadline will not be subject to the increased rate. This provision offers a window for travelers to secure lower fares before the new GST rates take effect.

Confirmation of GST Rates

Shivam Mehta, an executive partner at Lakshmikumaran & Sridharan Attorneys, confirmed that the GST rate for economy class air travel will remain at 5%. He noted that while the GST for premium classes will increase to 18%, service providers will still be eligible to claim input tax credit. This information has been officially confirmed in the published FAQ under Serial No. 59, providing further assurance to travelers regarding the upcoming changes in GST rates.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.

Follow Us on Twitter, Instagram, Facebook, & LinkedIn