Asian Shares Rise as Tech Stocks Soar Following Nvidia and OpenAI Partnership; Gold Reaches New High

Asian share markets are poised to build on their recent gains, fueled by a surge of investor enthusiasm surrounding artificial intelligence (AI) and technology stocks. This optimism is further bolstered by expectations of additional interest rate cuts from the United States, which have driven gold prices to unprecedented heights. Wall Street has also reached new records, particularly following Nvidia’s announcement of a substantial investment in OpenAI, signaling a robust outlook for the tech sector.

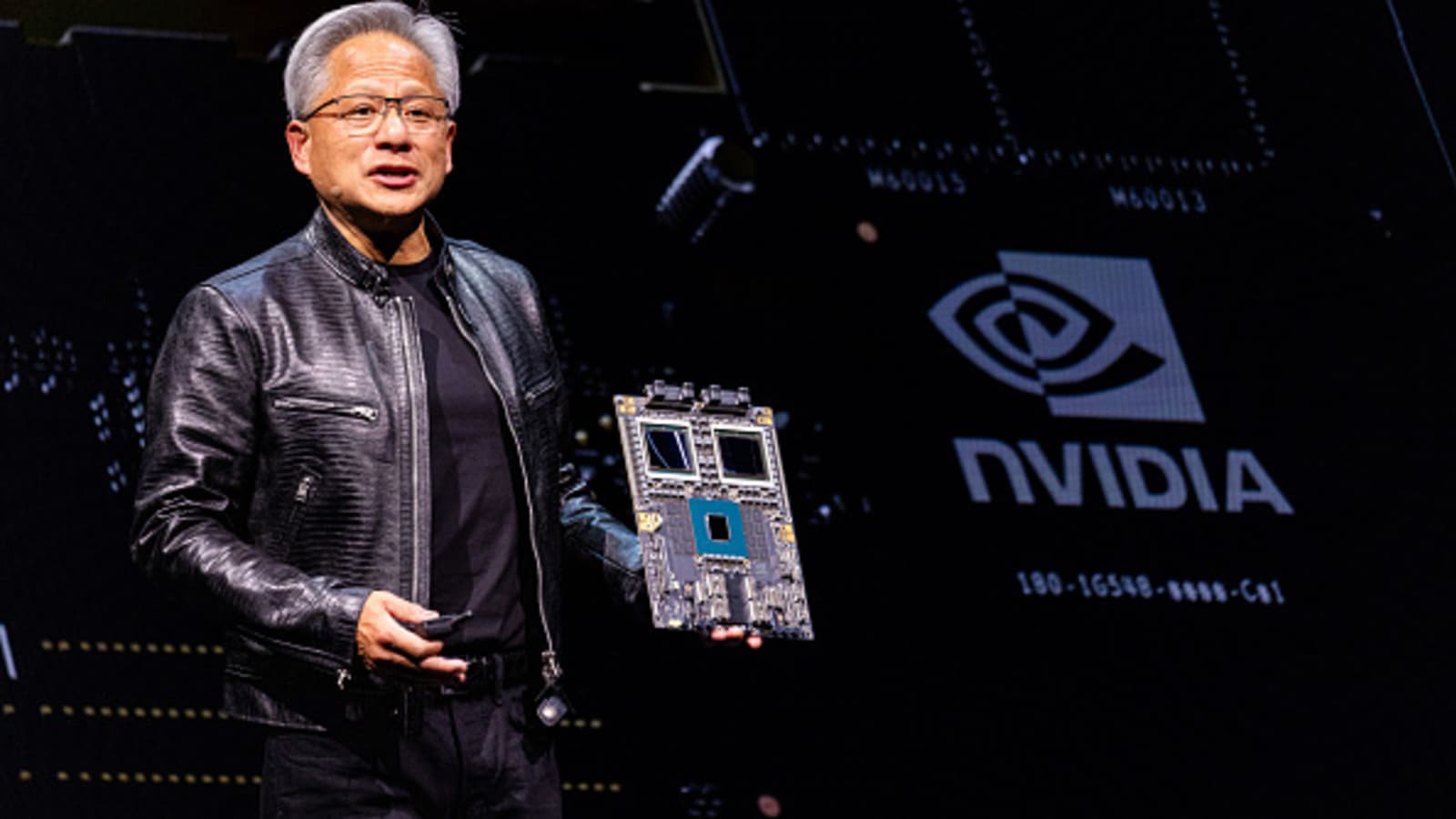

Tech Sector Rally

The tech sector has been a significant driver of market momentum, with companies like Oracle, Apple, Nvidia, and Tesla leading the charge. Chris Weston, head of research at Pepperstone, noted that the current enthusiasm for US tech and AI is so strong that it would take an unexpected event to disrupt the positive flow of investments. This rally has attracted considerable capital from momentum funds and options traders, creating a self-reinforcing cycle of investment. As a result, the chip sectors across Asia have also benefited, with South Korean stocks rising by 0.2% and Taiwan’s market climbing nearly 7% this month. Japan’s Nikkei index, although closed for a holiday, has seen a 6.5% increase in September. Meanwhile, the MSCI index tracking Asia-Pacific shares outside Japan has gained 0.3%, marking a 5.5% rise for the month. Chinese blue chips have also edged up by 0.1%.

Federal Reserve’s Mixed Signals

Global equities are being supported by expectations of further rate cuts from the Federal Reserve, following a recent easing of monetary policy. Futures markets indicate a 90% likelihood of a quarter-point cut in October and a 75% chance of another cut in December. Despite this dovish sentiment, the Federal Reserve has sent mixed signals. New Fed Governor Stephen Miran, appointed by former President Donald Trump, has advocated for significantly lower rates, while three other officials have cautioned against potential inflation risks. Fed Chair Jerome Powell is scheduled to address the economic outlook and policy later today, which could provide further clarity. Additionally, the bond market is reacting to these expectations, with Treasury yields being supported as investors prepare for a significant wave of government and corporate debt issuance this week.

Currency and Commodity Markets

In the currency markets, the US dollar has softened after three consecutive days of gains. The euro has stabilized at $1.1809, recovering from a low of $1.1726 on Monday. The dollar has also dipped against the yen, falling to 147.68 from a high of 148.37. Meanwhile, Sweden’s crown has remained steady at 9.3497 per dollar ahead of an upcoming central bank meeting, where futures suggest a one-in-three chance of a rate cut. In the commodities sector, oil prices have faced pressure due to concerns over oversupply, overshadowing geopolitical tensions in regions like Russia and the Middle East. Brent crude has decreased by 0.2% to $66.46 a barrel, while US crude has dipped 0.1% to $62.21 per barrel.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.