Anticipation Grows for RBI’s Upcoming MPC Meeting

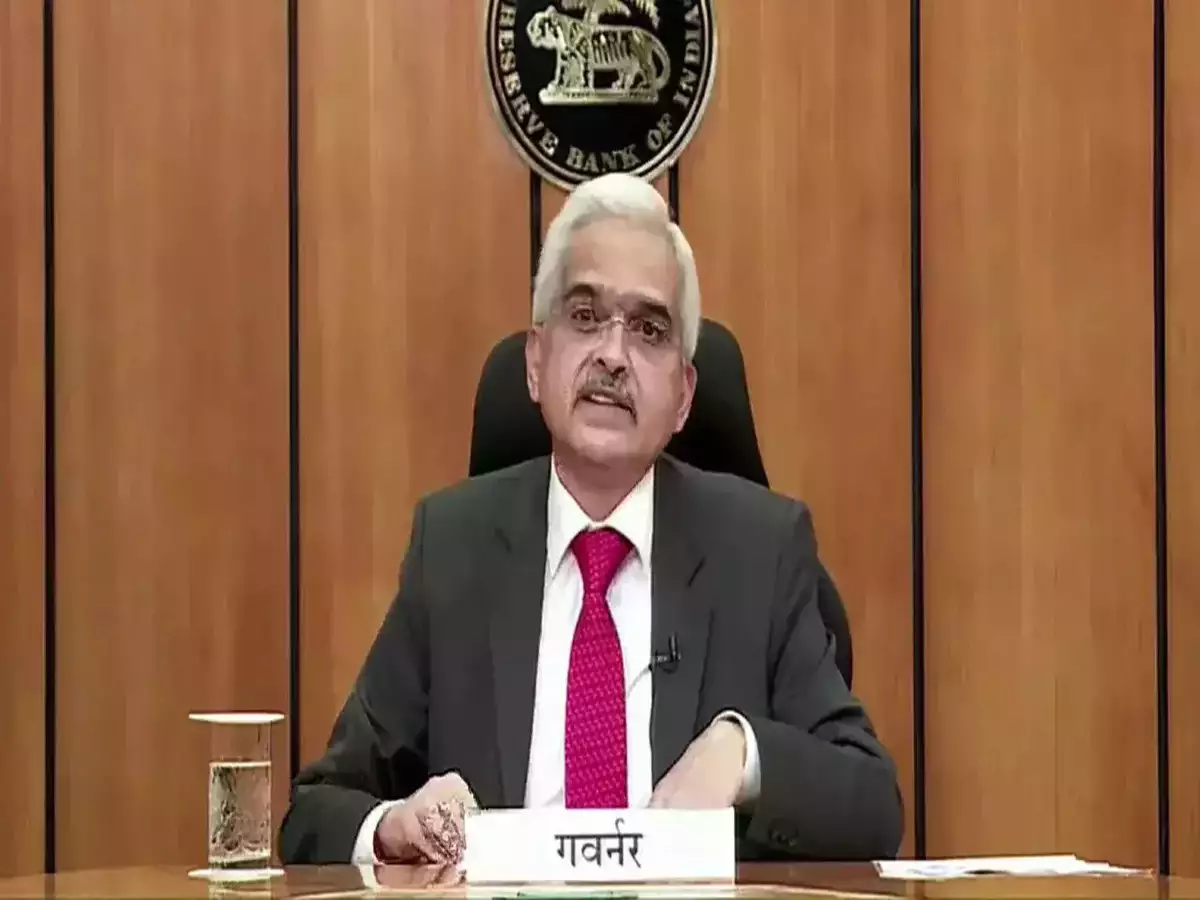

The Reserve Bank of India (RBI) is set to hold its Monetary Policy Committee (MPC) meeting this week, drawing significant attention from economists and market watchers. This meeting is particularly noteworthy as it marks the first under the newly appointed RBI Governor, Sanjay Malhotra. With the backdrop of a recent Union Budget aimed at boosting consumption, many are eager to see if the RBI will respond with a repo rate cut. The current economic climate, characterized by a slowdown in GDP growth, adds urgency to the discussions.

RBI Monetary Policy Meeting: Date and Time

The RBI’s MPC meeting commenced on February 5, 2025, and will conclude with an announcement on February 7, 2025, at 10:00 AM. Governor Sanjay Malhotra’s first statement will be closely scrutinized for insights into the central bank’s future direction. Analysts expect that he will provide clarity on the RBI’s stance regarding GDP growth and inflation forecasts.

The timing of this meeting is crucial. It follows the Union Budget 2025, which aims to stimulate the economy through changes in income tax slabs. The RBI’s decisions will be pivotal in determining whether these fiscal measures translate into real economic growth. As the meeting unfolds, stakeholders will be looking for indications of how the RBI plans to balance inflation control with the need for economic stimulus.

Where to Watch the RBI MPC Meeting

For those interested in following the developments of the MPC meeting, the RBI will stream Governor Sanjay Malhotra’s statement live on its official YouTube channel starting at 10:00 AM on February 7, 2025. This platform will provide real-time updates and insights into the RBI’s monetary policy decisions.

In addition to the live stream, The Times of India will offer a detailed analysis through its live blog. This will include expert commentary on the implications of the MPC’s decisions for the economy and for borrowers. As the meeting approaches, anticipation builds around what the RBI’s decisions will mean for various sectors, particularly in light of the recent economic challenges.

What to Expect from the MPC Meeting

As the RBI prepares for its MPC meeting, expectations are high for a potential repo rate cut of 25 basis points. This would be the first rate reduction in five years, a significant move considering the current economic landscape. The last time the RBI cut the repo rate was in May 2020, aimed at mitigating the economic fallout from the COVID-19 pandemic.

Despite concerns about a weakening rupee, inflation rates have remained within acceptable limits. Recent analyses suggest that retail inflation, based on the Consumer Price Index (CPI), is likely to decrease to around 4.5% in the fourth quarter of the fiscal year. This creates a favorable environment for the RBI to consider a rate cut, especially as the economy grapples with a slowdown in GDP growth, which fell to a two-year low of 5.4% in the second quarter of FY 2024-25.

Experts believe that a repo rate cut would align with the Union Budget’s focus on consumption-driven growth. The State Bank of India’s research department anticipates a cumulative rate cut of at least 75 basis points over the coming months, with potential cuts occurring in February and April 2025. This proactive approach could provide the necessary stimulus to support economic recovery in the wake of recent challenges.

As the MPC meeting approaches, all eyes will be on the RBI’s decisions and the broader implications for India’s economy.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.

Follow Us on Twitter, Instagram, Facebook, & LinkedIn