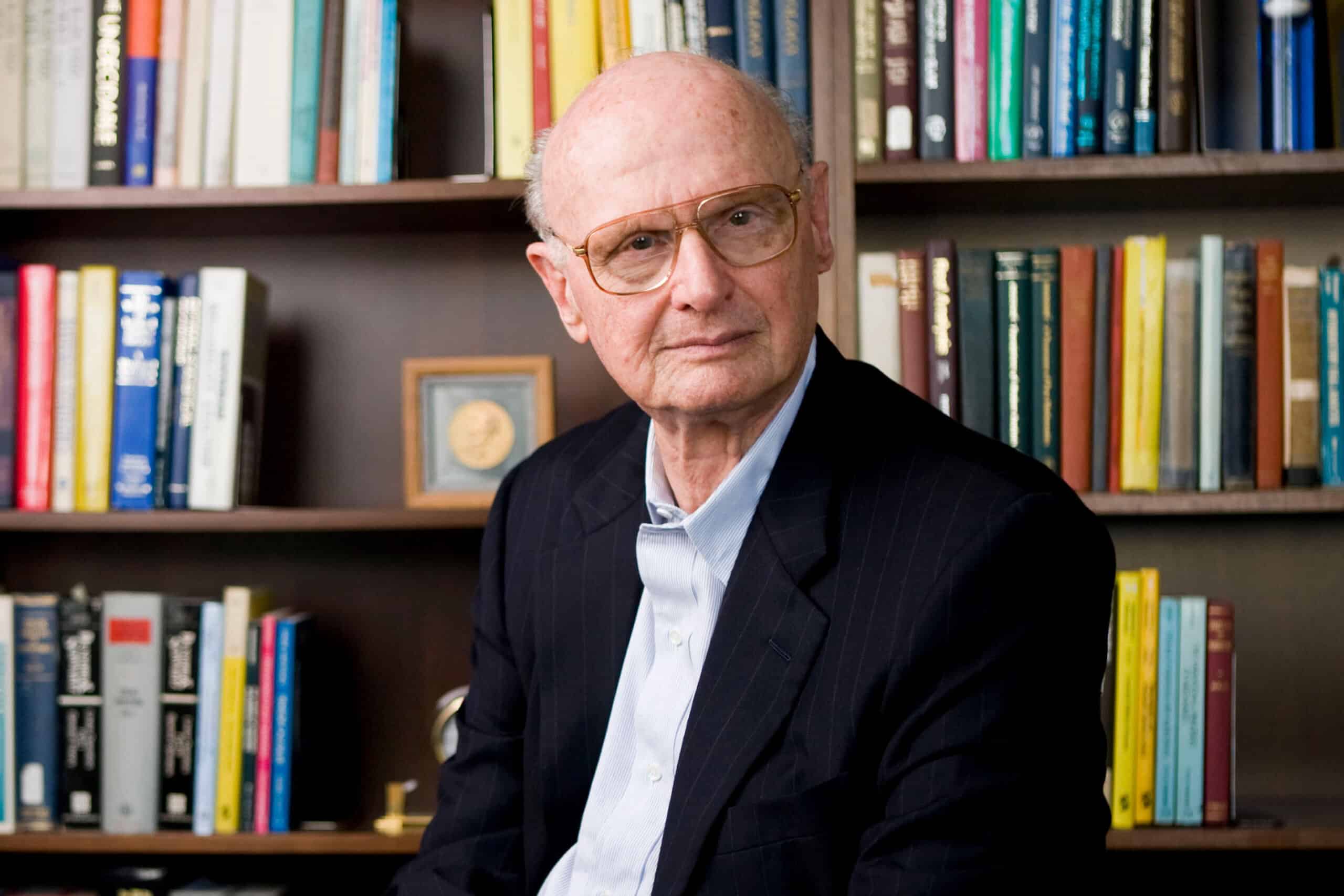

Harry Markowitz: The Architect of Modern Portfolio Theory

Harry Markowitz (24 August 1927 – 22 June 2023) was an American economist. Harry Markowitz was awarded the Nobel Prize in Economic Sciences in 1990.

Early Life And Education

Harry Markowitz, born on August 24, 1927, in Chicago, Illinois, was the son of Morris and Mildred Markowitz. His parents owned a small grocery store, and he was their only child. During his high school years, Markowitz developed a keen interest in physics and philosophy, particularly influenced by the ideas of David Hume. This interest carried over into his undergraduate studies at the University of Chicago, where he initially pursued a liberal arts education. He completed his Ph.B. in Liberal Arts in 1947, and inspired by his burgeoning interest in economics, he continued his education at the same institution. Under the tutelage of notable economists such as Milton Friedman, Tjalling Koopmans, Jacob Marschak, and Leonard Savage, Markowitz decided to specialize in economics. His academic journey at the University of Chicago culminated with an A.M. in Economics in 1950 and a Ph.D. in 1954. It was during his time as a student that he became a member of the Cowles Commission for Research in Economics, which significantly shaped his future contributions to financial economics.

Career And Achievements

Harry Markowitz pursued his passion for economics and finance at the University of Chicago, where he was influenced by eminent economists such as Milton Friedman and Leonard Savage. His seminal contribution to economics came with the development of modern portfolio theory, which introduced critical concepts of asset risk, return, correlation, and diversification in investment portfolio returns. This work earned him the prestigious John von Neumann Theory Prize in 1989. The following year, Markowitz’s contributions were further recognized when he was awarded the Nobel Memorial Prize in Economic Sciences, sharing the honor with Merton H. Miller and William F. Sharpe for their collective work in financial economics. Markowitz’s academic journey included notable tenures at institutions like the RAND Corporation and Baruch College, and his influence extended beyond academia through his development of the SIMSCRIPT programming language. His legacy continues to shape the strategies of investors and the theoretical underpinnings of financial economics.

Notable Events And Milestones

Harry Markowitz seminal paper, published in 1952, introduced the concept of an ‘efficient frontier’, a foundational component of MPT, which revolutionized the understanding of investment risk and reward. This work earned him the Nobel Prize in Economics in 1990, a testament to the profound impact of his research on financial economics. Markowitz’s contributions extended beyond academia; he developed SIMSCRIPT, a programming language for simulation, which had significant implications for operations research and economic analysis. His ideas on diversification and risk management have become standard practice in the finance industry, influencing investment strategies and portfolio management worldwide. The tools and techniques he introduced have helped countless investors to optimize their portfolios, balancing risk against expected returns, and his influence permeates modern financial theory and practice.

Moreover, Markowitz’s legacy is not confined to finance alone; his theories have found applications in various fields, including engineering, business, and even healthcare, where risk assessment and management are crucial. His interdisciplinary approach showcased the versatility of economic theory when applied to real-world problems, thereby expanding the boundaries of how economic principles can be utilized to enhance decision-making processes across different sectors.

The passing of Harry Markowitz on June 22, 2023, marked the end of an era, but his legacy endures through the continued relevance of his theories in today’s complex financial landscape. His life’s work stands as a testament to the power of innovative thinking and its capacity to drive progress, shape industries, and influence global economic policies.

Awards And Honors

- John von Neumann Theory Prize (1989)

- The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel (1990)

- Institute for Operations Research and the Management Sciences Fellow (2002)

- President of the American Finance Association (1982-83)

These awards highlight Harry Markowitz’s significant contributions to the field of economics, particularly in the areas of financial economics and asset management. His work has had a lasting impact on both theoretical finance and practical asset management, as recognized by these prestigious honors.

Additional Resources

Books:

- “Portfolio Selection: Efficient Diversification of Investments” by Harry M. Markowitz.

- “Risk-Return Analysis: The Theory and Practice of Rational Investing (Volume One)” by Harry M. Markowitz.

- “The Fundamental Index: A Better Way to Invest” with a foreword by Harry M. Markowitz.

- “Harry Markowitz: Selected Works” available on Google Books.

Documentaries:

- “Masters of Finance: Harry Markowitz” available on YouTube.

- “In Pursuit of the Perfect Portfolio: Harry M. Markowitz” by MIT Laboratory for Financial Engineering.

- “Dr. Harry Markowitz, Father of Modern Portfolio Theory” by GuidedChoice.

Museums:

- While there may not be a museum dedicated solely to Harry Markowitz, finance-related museums or exhibitions, such as those at the Museum of the City of New York, may feature information about his work and contributions to economic sciences. Additionally, universities with finance and economics programs may have archives or displays featuring Markowitz’s work.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.