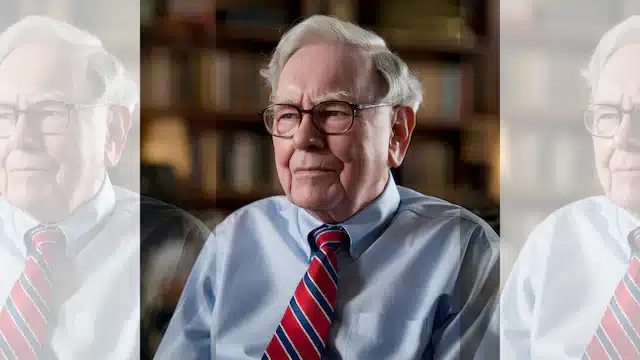

Warren Buffett Defies Market Trends with Wealth Surge

In a striking contrast to the ongoing global market turmoil of 2025, Warren Buffett has emerged as the only billionaire among the world’s top 15 richest individuals to see an increase in his net worth. As investors grapple with significant stock market declines, Buffett’s fortune has grown to $155 billion, marking a $12.7 billion rise year-to-date. This development comes amidst a backdrop of economic instability triggered by Donald Trump’s return to the U.S. presidency and his controversial tariff policies.

Market Turmoil and Wealth Decline

The financial landscape has been tumultuous since Donald Trump resumed office, leading to a staggering loss of approximately $8 trillion in market value on Wall Street. Trump’s implementation of the largest tariff increase in a century resulted in nearly $6 trillion evaporating in just two trading sessions. The markets suffered a significant blow on Friday, with a single-day decline of $329 billion, the worst since the Covid-19 pandemic. Last Thursday alone saw the world’s 500 wealthiest individuals lose a collective $208 billion, marking the fourth-largest daily drop in the Bloomberg Billionaires Index’s history.

Prominent billionaires have not been spared from this downturn. Elon Musk’s net worth plummeted by $130 billion, leaving him with $302 billion. Jeff Bezos saw a $45.2 billion decrease, bringing his total to $193 billion. Other notable losses include Mark Zuckerberg, whose wealth fell by $28.1 billion to $179 billion, and Bernard Arnault, who lost $18.6 billion, now valued at $158 billion. Even Bill Gates experienced a $3.38 billion reduction, matching Buffett’s net worth at $155 billion.

Buffett’s Strategic Investments

While many investors face uncertainty, Buffett’s company, Berkshire Hathaway, has adopted a strategic long-term approach. Under his leadership, Berkshire has reduced its stakes in American technology stocks, including Apple and Bank of America, while increasing investments in Japanese trading companies. Earlier this year, Buffett bolstered Berkshire’s holdings in Japan’s primary trading houses, including Mitsui, Mitsubishi, Sumitomo, Itochu, and Marubeni, which are vital to Japan’s industrial and commercial sectors.

Berkshire’s investments in these companies have proven fruitful, with holdings now at 9.82% in Mitsui & Co., 9.67% in Mitsubishi Corp., 9.29% in Sumitomo Corp., 8.53% in Itochu Corp., and 9.30% in Marubeni Corp. This strategic pivot has contributed to Berkshire Hathaway’s market capitalization exceeding $1.14 trillion, surpassing Tesla and significantly boosting Buffett’s personal wealth.

Economic Forecasts and Future Implications

The impact of Trump’s stringent tariff policies has disrupted international supply chains and shaken investor confidence. In light of these developments, JP Morgan has revised its U.S. GDP growth forecast for 2025 downward to -0.3%, a significant drop from the previous estimate of 1.3%. Michael Feroli, the firm’s chief U.S. economist, predicts a two-quarter recession beginning in the third quarter, with anticipated declines of 1% in Q3 and 0.5% in Q4.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.