Union Budget 2025-26: Empowering MSMEs for Growth

The Union Budget for 2025-26 has been unveiled, presenting a roadmap for the next five years. The government aims to realize the vision of ‘Sabka Vikas’ or inclusive growth, focusing on balanced development across all regions. This budget emphasizes the importance of Micro, Small, and Medium Enterprises (MSMEs) as vital engines of economic growth. The proposed measures are designed to accelerate the growth of these enterprises, ensuring that development is inclusive and benefits all sections of society.

Enhancements in MSME Classification

During the presentation of the Union Budget, Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman, announced significant changes to the classification criteria for MSMEs. The investment and turnover limits for these enterprises will be increased to 2.5 times and 2 times, respectively. This revision aims to help MSMEs achieve higher efficiencies, upgrade technology, and gain better access to capital.

Currently, there are over 1 crore registered MSMEs in India, employing approximately 7.5 crore people. These enterprises contribute to 36% of the country’s manufacturing output and are responsible for 45% of exports. By enhancing the classification criteria, the government hopes to instill confidence in MSMEs, encouraging them to expand and create more job opportunities for the youth. The new limits will allow micro enterprises to invest up to Rs. 2.5 crore and have a turnover of Rs. 10 crore. Small enterprises can now invest Rs. 25 crore and have a turnover of Rs. 100 crore, while medium enterprises can invest Rs. 125 crore and have a turnover of Rs. 500 crore. This strategic move is expected to position India as a global manufacturing hub.

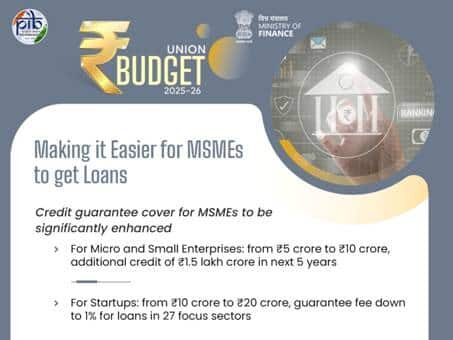

Improved Access to Credit for MSMEs

Access to credit has always been a challenge for MSMEs. To address this issue, the Union Budget proposes a significant enhancement of credit availability. The credit guarantee cover for micro and small enterprises will increase from Rs. 5 crore to Rs. 10 crore. This change is expected to unlock an additional credit of Rs. 1.5 lakh crore over the next five years.

For startups, the credit guarantee will rise from Rs. 10 crore to Rs. 20 crore, with a reduced guarantee fee of 1% for loans in 27 focus sectors crucial for Atmanirbhar Bharat. Furthermore, well-run exporter MSMEs will benefit from term loans of up to Rs. 20 crore.

In addition to these measures, customized credit cards with a limit of Rs. 5 lakh will be introduced for micro enterprises registered on the Udyam portal. The government plans to issue 10 lakh such cards in the first year. These initiatives aim to enhance the financial ecosystem for MSMEs, enabling them to thrive and contribute to the economy.

Support for Startups and First-Time Entrepreneurs

The Union Budget also emphasizes support for startups and first-time entrepreneurs. A new Fund of Funds will be established, with an additional government contribution of Rs. 10,000 crore. This fund aims to support Alternate Investment Funds (AIFs) for startups, which have already received commitments exceeding Rs. 91,000 crore.

Moreover, a new scheme will be launched to assist 5 lakh first-time entrepreneurs, particularly women, Scheduled Castes, and Scheduled Tribes. This scheme will provide term loans of up to Rs. 2 crore over the next five years. The initiative will incorporate lessons from the successful Stand-Up India scheme and will include online capacity-building programs to enhance entrepreneurship and managerial skills.

Additionally, the government plans to explore a Deep Tech Fund of Funds to catalyze the next generation of startups. This initiative reflects the government’s commitment to fostering innovation and entrepreneurship in the country.

Export Promotion Mission for MSMEs

To further bolster the MSME sector, the Union Budget introduces an Export Promotion Mission. This mission will have sectoral and ministerial targets and will be driven by the Ministries of Commerce, MSME, and Finance. The mission aims to facilitate easy access to export credit and provide cross-border factoring support. It will also assist MSMEs in navigating non-tariff measures in international markets.

By establishing this mission, the government seeks to enhance the global competitiveness of Indian MSMEs. The focus on exports is crucial for driving economic growth and positioning India as a key player in the global market. With these comprehensive measures, the Union Budget 2025-26 aims to empower MSMEs, ensuring they play a pivotal role in the nation’s economic development.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.

Follow Us on Twitter, Instagram, Facebook, & LinkedIn