Surge in Securitisation Volumes in India

The Indian financial landscape is witnessing a significant surge in securitisation volumes. According to recent data from ICRA, securitisation volumes soared by 80% year-on-year, reaching an impressive Rs 68,000 crore in the December quarter. This remarkable growth has prompted ICRA to revise its total volume estimates for the current financial year to Rs 2.4 lakh crore, up from the previous forecast of Rs 2.1 lakh crore. This marks a substantial increase of 25% compared to the Rs 1.92 lakh crore recorded in FY24. This article delves into the factors driving this growth, the implications for the banking sector, and the challenges faced by non-banking financial companies (NBFCs).

Understanding Securitisation

Securitisation is a financial process that allows lenders to convert future receivables, such as loan repayments, into immediate cash. In this process, a lender transfers the rights to these future payments to another party. This exchange provides the lender with liquidity, enabling them to reinvest or meet other financial obligations. Investors, in turn, earn returns from the receivables over time.

The securitisation process is particularly beneficial for banks and financial institutions. It allows them to manage their balance sheets more effectively while providing investors with opportunities to earn returns. The recent surge in securitisation volumes indicates a growing acceptance of this financial tool among lenders, particularly private banks. As these institutions continue to sell down their portfolios, they are unlocking significant amounts of capital, which can be used to support further lending activities.

This financial mechanism has become increasingly important in the current economic climate, where liquidity is crucial for maintaining operational stability. The rise in securitisation volumes reflects a broader trend in the financial sector, where institutions are seeking innovative ways to manage their assets and liabilities.

Private Banks Drive Growth

The latest data reveals that private sector banks have played a pivotal role in the surge of securitisation volumes. The October-December quarter saw volumes matching those of the previous quarter, indicating a steady demand for securitisation as a funding mechanism. Traditionally, non-bank lenders have relied heavily on securitisation to raise funds. However, the recent trend shows that private banks are increasingly engaging in this practice.

Abhishek Dafria, head of structured finance ratings at ICRA, highlighted that the ongoing sell-down of portfolios by private banks is a key driver of growth in the third quarter. This strategy allows banks to improve their liquidity positions while managing their credit-to-deposit ratios. As competition for deposits intensifies, banks are turning to securitisation as a viable alternative to bolster their funding sources.

The shift towards securitisation by private banks is also influenced by the recent merger of HDFC Bank. This merger has prompted the bank to rely more on securitisation to maintain its competitive edge in the market. As banks continue to navigate the challenges posed by deposit growth, securitisation is expected to remain a crucial tool for managing liquidity and supporting lending activities.

Challenges in the NBFC Sector

While the securitisation market is thriving, the non-banking financial company (NBFC) sector faces significant challenges. Vehicle loans continue to dominate securitisation volumes, but the growth in the third quarter was tempered by muted disbursements in the NBFC sector. This slowdown is particularly evident in microfinance and personal loans, where asset quality concerns have emerged.

Dafria noted that the increasing asset quality stress in personal and unsecured business loans has led to a decline in securitisation volumes for these categories. The headwinds faced by the NBFC sector, coupled with concerns about asset quality, have contributed to a more cautious approach to lending and securitisation.

Despite these challenges, ICRA remains optimistic about the overall credit quality of rated pass-through certificate (PTC) transactions. The agency believes that while the NBFC sector is experiencing difficulties, the impact on the broader securitisation market will be limited. As banks and financial institutions continue to adapt to changing market conditions, the securitisation landscape is likely to evolve, presenting both opportunities and challenges for various stakeholders.

Trends and Future Outlook

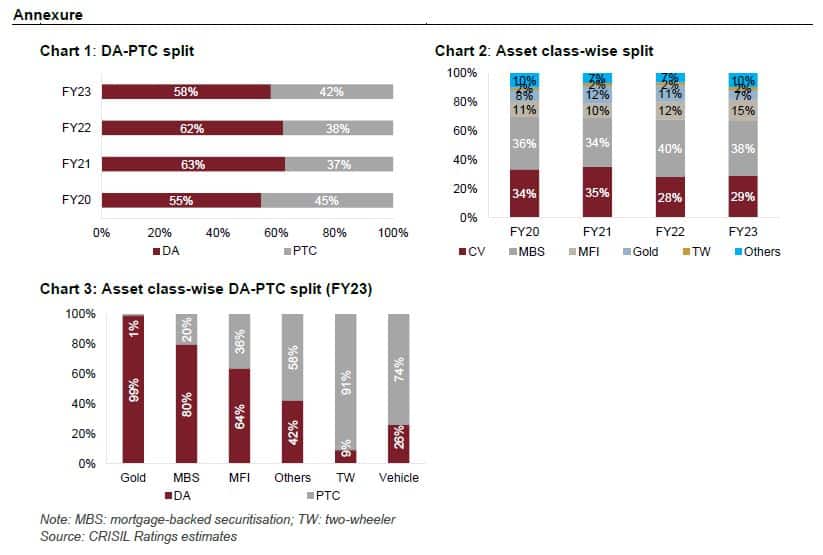

The trends in securitisation volumes indicate a dynamic shift in the Indian financial market. Approximately 60% of the total securitisation volumes were driven by PTC issuances, while the remainder came from direct sell-downs. Public sector banks tend to prefer the direct assignment route, whereas private sector banks favor PTCs. This differentiation highlights the varying strategies employed by different types of banks in managing their assets.

Vehicle loans remain a dominant asset class in the securitisation market, with banks and NBFCs frequently securitising car and commercial vehicle loan portfolios. However, the growth of microfinance loans has slowed in recent quarters due to asset quality concerns. This trend underscores the importance of maintaining robust asset quality standards to support sustainable growth in the securitisation market.

Looking ahead, ICRA anticipates that securitisation will continue to play a vital role in the financial sector. As banks and financial institutions navigate the complexities of the current economic environment, securitisation will remain a key strategy for managing liquidity and supporting lending activities. The ongoing evolution of the securitisation market will be closely monitored as stakeholders adapt to changing market dynamics and regulatory frameworks.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.