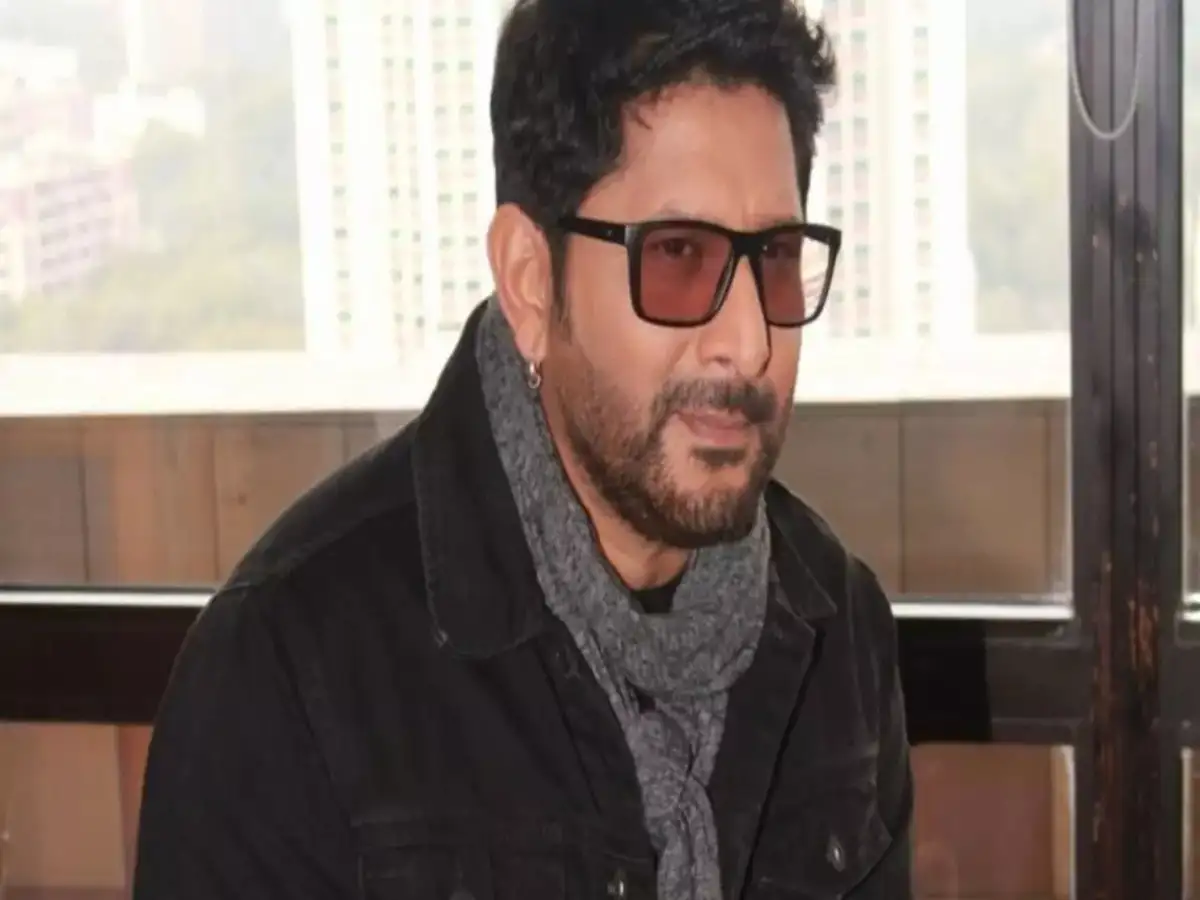

SEBI Imposes Ban on Actor Arshad Warsi, His Wife, and 57 Others

The Securities and Exchange Board of India (Sebi) has taken significant action against actor Arshad Warsi, his wife Maria Goretti, and 57 other individuals for their involvement in misleading YouTube videos promoting shares of Sadhna Broadcast. Each of the prominent figures has been fined Rs 5 lakh and banned from participating in securities markets for one year. The total penalties imposed on the group amount to substantial sums, with the regulator demanding the return of illegal profits totaling Rs 58.01 crore, plus interest.

Details of the Regulatory Action

Sebi’s directive, issued on Thursday, outlines the penalties and restrictions placed on Warsi, Goretti, and the other involved parties. The regulatory body has prohibited these individuals from engaging in securities markets for periods ranging from one to five years. The penalties for the remaining 57 individuals vary, with amounts ranging from Rs 5 lakh to Rs 5 crore. This action is part of a broader investigation into deceptive practices surrounding the promotion of Sadhna Broadcast, which is currently known as Crystal Business System Ltd.

The investigation revealed that Arshad Warsi profited Rs 41.70 lakh from these activities, while Maria Goretti gained Rs 50.35 lakh. The regulatory body has mandated that all involved parties collectively return the illegal profits, along with an additional 12 percent annual interest, until the total amount is settled. This decision underscores Sebi’s commitment to maintaining integrity in the securities market.

Uncovering the Scheme

Sebi’s findings identified key orchestrators of the fraudulent scheme, including Gaurav Gupta, Rakesh Kumar Gupta, and Manish Mishra. The order also highlighted the role of Subhash Aggarwal, a director of Sadhna Broadcast’s registrar and transfer agent, who acted as an intermediary between Mishra and the promoters. These individuals were pivotal in executing the deceptive plan, which involved manipulating share prices through coordinated trading activities.

Additionally, Peeyush Agarwal and Lokesh Shah were implicated for allowing their accounts to be used for the fraudulent strategies orchestrated by Mishra and the promoters. Their involvement as a dealer and stockbroker facilitated extensive market manipulation. The investigation revealed that Jatin Shah played a crucial role in implementing the scheme, while others participated for quick profits, contributing to the overall fraudulent activities.

Execution of the Manipulative Strategy

According to the 109-page directive, Sebi detailed how the scheme was executed in two coordinated stages. Initially, entities connected to the promoters engaged in trades among themselves to artificially inflate the share price of Sadhna Broadcast. These small-volume transactions had a disproportionate impact on pricing due to limited market liquidity, allowing the involved parties to elevate the share value with minimal trading resources.

Following this, promotional content was disseminated through various YouTube channels, including ‘Moneywise’, ‘The Advisor’, and ‘Profit Yatra’, all managed by Manish Mishra. These videos portrayed Sadhna Broadcast as a lucrative investment opportunity and were strategically timed to coincide with the manipulated market activities. This approach aimed to attract unsuspecting investors and further enhance the artificial market activity surrounding the stock.

The comprehensive investigation by Sebi highlights the importance of regulatory oversight in preventing market manipulation and protecting investors from deceptive practices.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.