RBI Governor Emphasizes Demand Boost as Inflation Stabilizes

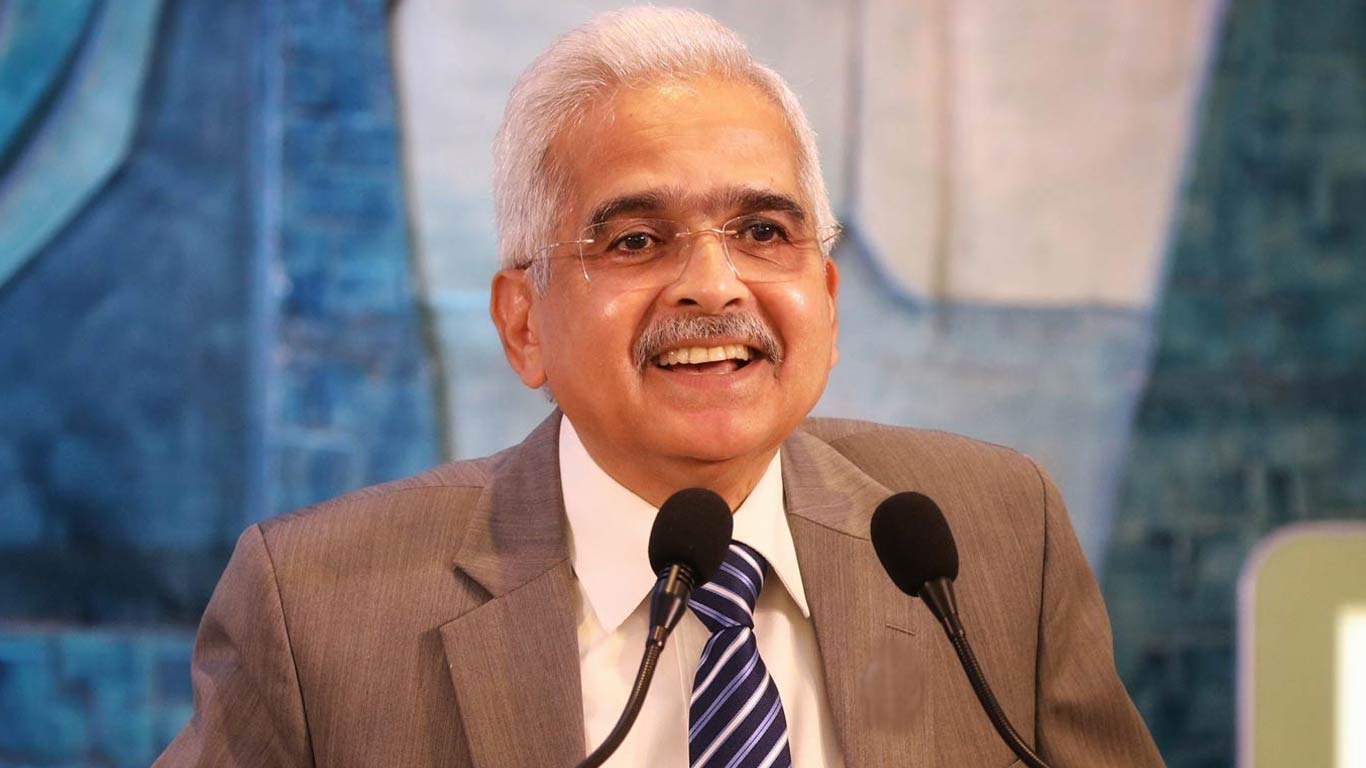

The Reserve Bank of India (RBI) is signaling a shift towards supporting economic growth, as indicated by the minutes from its recent monetary policy committee (MPC) meeting. Governor Sanjay Malhotra highlighted that current economic conditions are favorable for easing monetary policy. With inflation stabilizing around the 4% target and growth remaining moderate, the MPC unanimously decided to lower the policy rate by 25 basis points, adopting a more accommodative stance to bolster domestic demand.

Monetary Policy Adjustments

During the MPC meeting held on April 9, the committee members expressed a collective agreement on the need to adjust the policy rate. The unanimous decision to cut the rate by 25 basis points reflects the RBI’s confidence in managing inflation while fostering economic growth. Malhotra emphasized that the focus of monetary policy should now shift towards enhancing domestic demand to sustain and accelerate economic momentum. This approach aims to create a more favorable environment for consumers and businesses alike, encouraging spending and investment.

Malhotra also addressed the complexities surrounding tariffs and their dual impact on inflation. He noted that while uncertainties could lead to currency pressures and imported inflation, a slowdown in global growth might reduce commodity and crude oil prices, thereby alleviating inflationary pressures. This balancing act underscores the RBI’s commitment to navigating both external risks and domestic priorities effectively.

Liquidity Operations and Economic Outlook

Following the MPC meeting, Barclays released a research note describing the minutes as ‘dovish.’ The note highlighted the RBI’s ongoing liquidity operations, which include bond purchases totaling Rs 40,000 crore and long-dated variable rate repo operations amounting to Rs 1.5 lakh crore. These measures are designed to inject liquidity into the banking system, supporting the transmission of interest rate changes to the broader economy.

Additionally, amendments to the liquidity coverage ratio framework, set to take effect in April 2026, are expected to release Rs 1 lakh crore in loanable funds. This influx of capital is anticipated to further stimulate economic activity, providing banks with the resources needed to extend credit to businesses and consumers.

Concerns Over Global Economic Conditions

MPC member Nagesh Kumar raised concerns about the need to stimulate private consumption and investment, particularly in light of persistent global uncertainties. He pointed to a downgraded growth outlook for 2025-26 and warned that turbulence in global markets could negatively impact foreign direct investment and private capital expenditure. Kumar argued that the recent decline in inflation offers an opportunity for a more accommodative monetary policy, which could help mitigate these risks.

Saugata Bhattacharya also acknowledged the potential threats posed by global trade disruptions. He stressed the importance of supporting domestic growth in the face of possible external shocks. While he recognized the need for caution regarding trade tariffs, he refrained from advocating for aggressive policy measures, citing the resilience of the domestic economy. Bhattacharya concluded that the RBI’s liquidity actions would play a crucial role in facilitating the effective transmission of interest rate changes.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.