India’s Digital Payment Revolution

India is undergoing a remarkable transformation in its financial landscape. The country is rapidly moving towards a cashless society, driven by the surge in digital transactions. At the forefront of this revolution is the Unified Payments Interface (UPI), which has set new records in transaction volumes. With a staggering 16.73 billion transactions recorded in December 2024 alone, UPI is reshaping how Indians conduct financial transactions. Alongside UPI, other services like Immediate Payment Service (IMPS) and NETC FASTag are also playing crucial roles in this digital payment ecosystem. This article explores the rise of these digital payment methods and their impact on India’s economy.

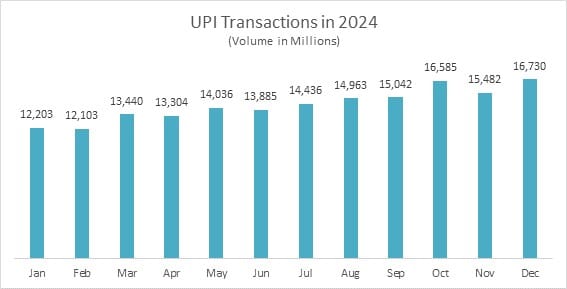

The Rise of UPI: A Game Changer

The Unified Payments Interface (UPI) has become a cornerstone of India’s digital payment landscape. This innovative system allows users to link multiple bank accounts to a single mobile application. It merges various banking features, enabling seamless fund routing and merchant payments. UPI has made financial transactions not only faster and more secure but also incredibly user-friendly.

Recent statistics from the National Payments Corporation of India (NPCI) reveal that UPI processed over 16.73 billion transactions in December 2024, with a total transaction value of Rs 23.25 lakh crore. This marks a significant increase from Rs 21.55 lakh crore in November. In 2024, UPI processed around 172 billion transactions, reflecting a 46% increase from the previous year. This growth highlights a cultural shift towards financial inclusivity, with UPI serving as a vital tool for individuals, small businesses, and merchants alike. The ease of use and accessibility of UPI has empowered millions, driving the country closer to its goal of a cashless economy.

IMPS: Instant Payments Anytime, Anywhere

While UPI has gained immense popularity, the Immediate Payment Service (IMPS) remains a trusted option for instant transactions. Launched in 2010, IMPS offers a real-time, 24/7 electronic funds transfer service. It allows users to make quick transactions across banks and financial institutions, ensuring that money can be transferred anytime and anywhere.

IMPS supports various channels, including mobile apps, ATMs, SMS, and the internet. This versatility has made it an essential tool for both businesses and individuals. Recent data shows that IMPS transactions surged to 441 million in December 2024, up from 407.92 million in November. The transaction value also increased significantly, reaching Rs 6.01 lakh crore in December, compared to Rs 5.58 lakh crore the previous month. The reliability and speed of IMPS make it a vital component of India’s digital payment infrastructure, complementing the services offered by UPI.

NETC FASTag: Revolutionizing Toll Payments

Another significant player in India’s digital payment ecosystem is the National Electronic Toll Collection (NETC) FASTag. This system offers a seamless, cashless method for paying tolls on national highways. By linking a FASTag to a bank account, drivers can pay tolls without stopping at toll plazas. This not only saves time but also reduces fuel consumption, contributing to a more efficient travel experience.

In December 2024, FASTag transactions reached 381.98 million, an increase from 358.84 million in November. The total transaction value also rose to Rs 6,642 crore, up from Rs 6,070 crore the previous month. The convenience of FASTag has made it increasingly popular among commuters, further driving the adoption of digital payments in India. As more drivers embrace this technology, the efficiency of toll collection is expected to improve significantly, benefiting both users and the government.

The Future of Digital Transactions in India

The surge in digital transactions through UPI, IMPS, and NETC FASTag signifies India’s growing acceptance of a digital-first economy. These technologies have simplified financial transactions, making them more secure and accessible. As India continues to enhance its digital infrastructure, the future of financial transactions looks promising.

The increasing adoption of digital payment methods reflects a broader trend towards financial inclusivity. With more people gaining access to digital banking services, the potential for economic growth is immense. As the country moves forward, the focus will likely remain on improving security measures and expanding the reach of digital payment systems. This will ensure that users can engage in commerce confidently, paving the way for a cashless society.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.