India Anticipates $25 Billion in IPO Activity Over the Coming Year

As the initial public offering (IPO) market experiences unprecedented growth, Citi is positioning itself at the forefront of this financial surge. The bank, which led both mergers and acquisitions (M&A) and equity banking last year, aims to enhance its market share by focusing on significant deals rather than smaller IPOs. In a recent interview, Rahul Saraf, Citi’s head of investment banking, shared insights on the current market dynamics and the factors driving this robust IPO activity.

Active Market Dynamics

The current deal-making environment is characterized by heightened activity in both M&A and equity sectors. Saraf noted that each transaction is driven by specific motivations, moving beyond mere high valuations. Private equity firms are actively seeking exits after securing substantial investments, while large conglomerates are spinning off businesses for IPOs as they achieve significant scale. Additionally, multinational corporations (MNCs) are reassessing their positions in India, leading to some exits as they realign their capital allocation strategies. Saraf emphasized the importance of identifying these market triggers early to capitalize on emerging opportunities.

Local Players and MNC Exits

The trend of MNCs exiting the Indian market can be attributed to the aggressive risk appetite of Indian entrepreneurs, which often contrasts with the more cautious approach of European boards. Saraf explained that many global firms are facing structural challenges in penetrating tier-2 and tier-3 markets. As a result, some foreign companies are realizing that their initial advantages in capital and technology have diminished, prompting a shift in strategy. This trend is evident in approximately 60-70% of such cases, highlighting the evolving landscape of competition in India.

IPO Projections and Market Sentiment

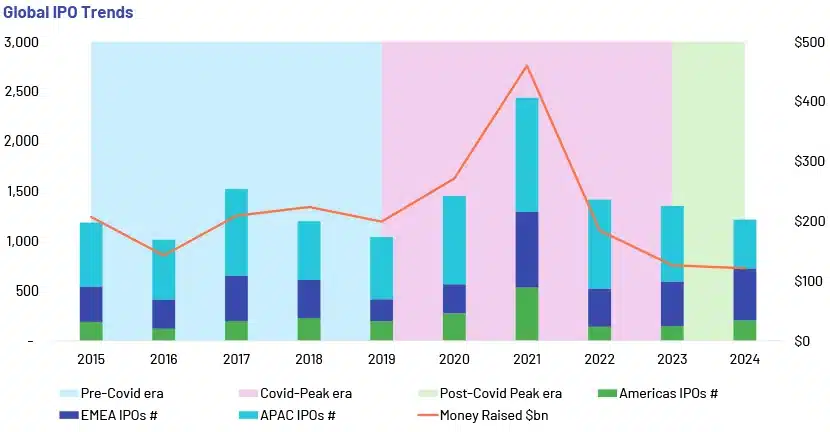

Despite some IPOs from the previous year trading below their issue prices, Saraf remains optimistic about the upcoming year. He pointed to Hyundai’s IPO, the largest in India, which is currently performing well above its issue price. With a robust pipeline of IPOs expected, including several valued between Rs 8,000 and Rs 10,000 crore, Saraf estimates that the market could see around $25 billion in IPOs and an additional $15-20 billion in qualified institutional placements (QIPs) and block trades. The driving forces behind this activity include private equity exits, MNC divestitures, and large corporate carve-outs, indicating a sustained demand for quality companies in the market.

Valuation Concerns and Future Outlook

While some analysts express concerns about potentially unsustainable valuations, Saraf argues that valuations are relative and must be viewed in context. He noted that while India may appear expensive from a European perspective, local companies often trade at competitive earnings multiples. India’s current valuation levels reflect consistent investment flows, economic growth, and political stability. Saraf believes that even if the market experiences short-term volatility, the long-term outlook remains strong, with ample liquidity supporting ongoing IPO activity. He concluded that the market’s focus on quality companies will continue to drive transactions, regardless of short-term fluctuations.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.

Follow Us on Twitter, Instagram, Facebook, & LinkedIn