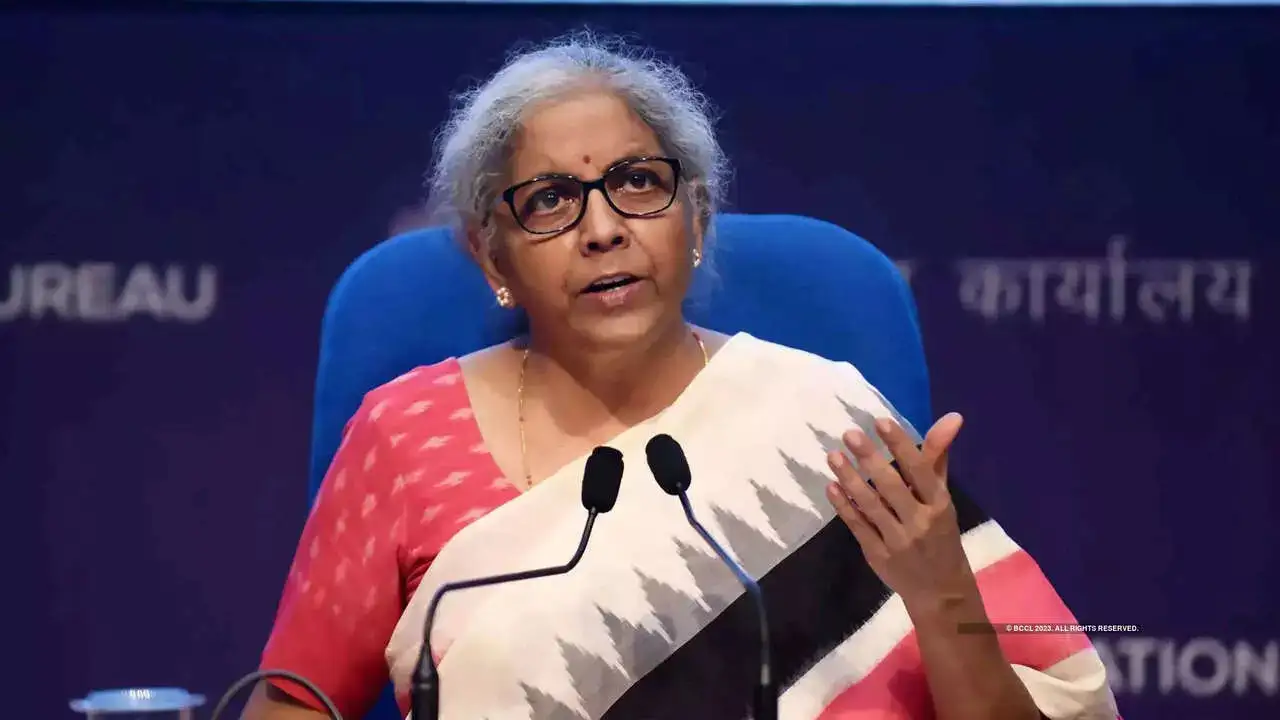

FM Nirmala Sitharaman Highlights Next-Gen GST Reforms for Enhanced Economic Transparency

Ahead of a pivotal meeting of the Goods and Services Tax (GST) Council, Finance Minister Nirmala Sitharaman announced significant reforms aimed at enhancing transparency and reducing compliance burdens for businesses. Speaking at an event hosted by City Union Bank, she emphasized that the proposed changes would simplify the current GST structure, making it more accessible for small businesses. The reforms are set to be discussed during the council meeting scheduled for Wednesday and Thursday, with the goal of fostering a more open economy.

Proposed Changes to GST Structure

The government is planning to streamline the GST system by reducing the number of tax slabs from five to three: 5%, 18%, and 40%. This move involves removing goods and services currently taxed at 12% and 28%. Sitharaman highlighted that this simplification would alleviate classification issues faced by businesses. The proposed reforms also suggest that all food items and textiles will be taxed at a uniform rate of 5%, while white goods, including refrigerators and air conditioners, will fall under the 18% category. Luxury items and certain sin goods, such as large cars, are expected to incur a 40% tax, with the possibility of eliminating the cess on these products.

The government believes that these adjustments will not only simplify the tax structure but also enhance compliance among businesses. By consolidating tax rates, the administration aims to create a more predictable environment for businesses, which could lead to increased economic activity and growth.

Challenges in Implementing Reforms

One of the significant challenges facing Sitharaman is gaining consensus among the various states, particularly those governed by opposition parties. These states have expressed concerns about potential revenue losses resulting from the proposed changes. They are advocating for compensation to offset any financial shortfalls. The Centre has acknowledged that it too may experience a temporary dip in revenue but argues that the long-term benefits of increased consumption will ultimately lead to a recovery in tax collections.

The GST Council, which comprises finance ministers from all states and Union Territories, will play a crucial role in determining the final structure of the reforms. Sitharaman’s ability to navigate these discussions and secure agreement from all parties will be vital for the successful implementation of the proposed changes.

Impact on Domestic Demand and Business Growth

The anticipated reforms are seen as essential for boosting domestic demand, particularly in light of recent challenges posed by international trade dynamics, including the 50% import duty imposed by the United States on Indian exports. Sitharaman emphasized the importance of these reforms in revitalizing the economy and supporting small and medium enterprises (MSMEs). She called on banks to enhance credit availability and invest in infrastructure to facilitate growth.

The finance minister underscored that the guiding principles for this transformation should be trust, technology, and transparency. By fostering a more supportive environment for businesses, the government aims to stimulate economic activity and ensure that the benefits of the reforms are felt across various sectors.

Improvement in Banking Sector

In her address, Sitharaman also noted significant improvements in the asset quality of scheduled commercial banks. She stated that macro stress tests indicate that these banks’ aggregate capital levels will remain above regulatory minimums, even under adverse conditions. This positive outlook for the banking sector is crucial as it aligns with the government’s broader economic objectives.

The finance minister’s remarks reflect a commitment to ensuring that the banking system remains robust and capable of supporting the economy through increased lending and investment. As the GST Council meeting approaches, the focus will be on how these proposed reforms can be effectively implemented to create a more transparent and efficient tax system that benefits all stakeholders.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.

Follow Us on Twitter, Instagram, Facebook, & LinkedIn