DIPAM’s Achievements and Strategies in 2024

The Department of Investment and Public Asset Management (DIPAM) has made significant strides in 2024, focusing on value creation for investors, strategic disinvestment, and efficient financial planning. The year has seen a continued emphasis on enhancing the performance of Central Public Sector Enterprises (CPSEs). This article delves into the key achievements and strategies implemented by DIPAM, showcasing its commitment to fostering growth and stability in the public sector.

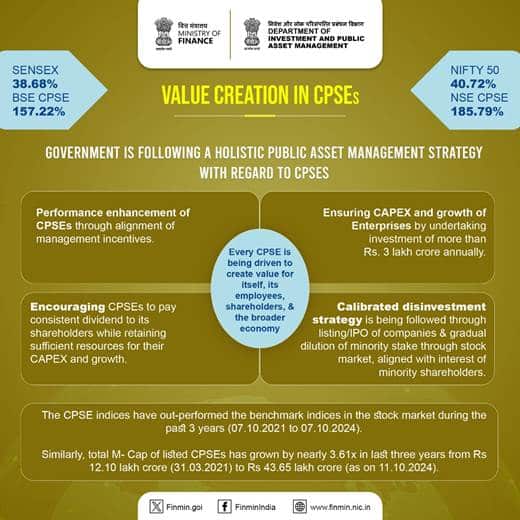

Focus on Value Creation in CPSEs

In 2024, DIPAM maintained its commitment to value creation within Central Public Sector Enterprises (CPSEs). Since the launch of the New PSE Policy in January 2021, the performance of CPSEs has been impressive. The NSE CPSE Index has recorded a remarkable return of 182.36%, while the BSE CPSE Index has seen a return of 146.92% as of November 2024. This growth reflects the effectiveness of the policies implemented by DIPAM.

DIPAM successfully launched Initial Public Offerings (IPOs) for key entities such as the Indian Renewable Energy Development Agency (IREDA) and MSTC Limited. Both IPOs received strong responses from investors, indicating a growing confidence in the public sector. Additionally, the Offer for Sale (OFS) mechanism was utilized to enhance the value of CPSEs like Hindustan Aeronautics Limited (HAL), Coal India Limited, and others. The OFS collectively generated ₹13,728 crore, demonstrating the positive momentum of these stocks and the confidence of investors.

DIPAM’s Consistent Dividend Policy has also played a crucial role in ensuring that CPSEs deliver value to their shareholders. In the fiscal year 2023-24, total dividend receipts from CPSEs reached ₹67,895 crore, significantly surpassing revised estimates. As of December 5, 2024, the government has realized ₹30,284 crore in dividend receipts, showcasing the effectiveness of this policy in promoting investor confidence.

Strategic Disinvestment Initiatives

DIPAM has adopted a calibrated approach to disinvestment, aligning with the interests of minority shareholders while ensuring the growth of CPSEs. In 2024, the department carried out several strategic disinvestment initiatives, including the Offer for Sale of the General Insurance Corporation of India (GIC). Launched on September 4, 2024, the GIC OFS was oversubscribed by 108.49% on the first day, leading to the exercise of the Green Shoe option. This successful transaction allowed the government to retain an 82.40% shareholding in GIC while realizing approximately ₹2,345.55 crore from the divestment.

Moreover, DIPAM facilitated the disinvestment of Ferro Scrap Nigam Limited (FSNL) through a Request for Proposal (RFP) process. The highest bid of ₹320 crore exceeded the reserve price, showcasing the growing interest in public sector assets. The transaction involved the sale of 100% equity in FSNL, along with the transfer of management control. This process was overseen by a multi-layered consultative mechanism, ensuring transparency and efficiency.

DIPAM’s strategic disinvestment initiatives not only generate revenue for the government but also enhance the operational efficiency of CPSEs. By gradually diluting minority stakes and listing companies on the stock market, DIPAM is fostering a more competitive environment that benefits both investors and the economy.

Revised Guidelines for Capital Restructuring

In response to evolving capital market conditions and regulatory changes, DIPAM issued revised guidelines on capital restructuring for CPSEs in 2024. These new guidelines supersede the earlier ones issued in May 2016. The updated framework aims to enhance the value of CPSEs and improve their performance by providing greater operational and financial flexibility.

The objectives of the revised guidelines include enabling CPSEs to play a more effective role in the country’s economic growth and allowing more investors to participate in value creation. By focusing on enhancing shareholder returns and improving operational efficiency, DIPAM is positioning CPSEs for sustainable growth in the future.

The guidelines reflect a comprehensive approach to public asset management, emphasizing the importance of aligning management incentives with performance enhancement. This strategy encourages CPSEs to pay consistent dividends while retaining sufficient resources for capital expenditure and growth. By fostering a culture of accountability and performance, DIPAM aims to create a robust public sector that contributes significantly to the national economy.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.