Chinese AI Venture Challenges US Tech Giants

The global technology landscape is undergoing a significant shift. A new player from China, DeepSeek, has emerged, raising eyebrows and concerns among established tech giants in the United States. This development has sparked a wave of reactions on Wall Street and beyond, as investors reassess the future of artificial intelligence (AI) and its implications for the market. The recent performance of the Nasdaq, heavily influenced by tech stocks, reflects this uncertainty.

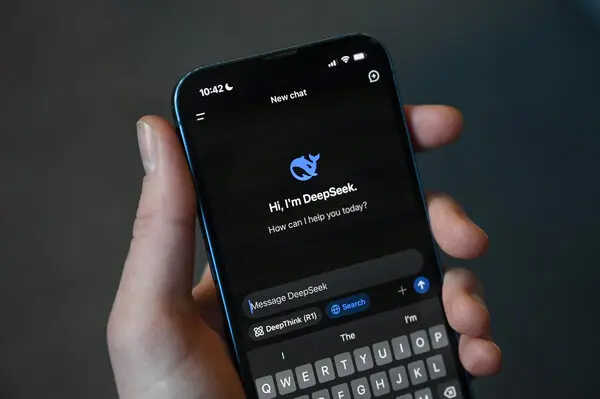

The Rise of DeepSeek

DeepSeek, a startup based in Hangzhou, China, has made headlines by developing a generative AI model that rivals those of leading American companies like Nvidia. The startup reportedly spent a mere $5.6 million on its AI model, a fraction of the billions invested by U.S. tech giants. This cost-effective approach has raised questions about the sustainability of American tech dominance in the AI sector. Kathleen Brooks, research director at XTB, emphasized that the emergence of DeepSeek signifies a challenge to U.S. supremacy in technology. She noted that the focus is now on whether China can outperform the U.S. in terms of speed, efficiency, and cost-effectiveness in AI development.

The implications of DeepSeek’s success are profound. The company’s AI assistant has quickly become the top-rated free application on Apple’s U.S. App Store. This rapid ascent has forced investors to reconsider their outlook on capital expenditures and valuations in the tech sector. The fear is that discount Chinese AI models may not only match but potentially exceed the capabilities of their American counterparts. As the competition heats up, U.S. companies like Meta, Microsoft, and Alphabet are under pressure to respond, especially with their earnings reports looming.

Market Reactions and Stock Performance

The immediate reaction to DeepSeek’s emergence was a sharp decline in the Nasdaq index, which fell by 2.7%. Major tech players, including Nvidia, saw significant drops in their stock prices, with Nvidia losing over 11% of its value, equating to a staggering $400 billion in market capitalization. This downturn reflects a broader concern among investors about the future profitability of U.S. tech firms in light of rising competition from China.

Analysts are closely monitoring the upcoming earnings reports from major tech companies. Meta and Microsoft, in particular, are expected to address the competitive landscape shaped by DeepSeek. Venture capitalist Marc Andreessen likened this moment to a “Sputnik moment,” referencing the shock the U.S. experienced when the Soviet Union launched its first satellite in 1957. The analogy underscores the urgency for American companies to innovate and adapt in response to this new challenge.

Global Market Dynamics and Trade Tensions

The emergence of DeepSeek is not the only factor affecting global markets. Recent trade tensions between the U.S. and Colombia have also contributed to market volatility. President Donald Trump announced a potential 25% tariff on Colombian goods, escalating to 50% if certain conditions are not met. This move came after Colombian President Gustavo Petro blocked deportation flights from the U.S., leading to a diplomatic standoff.

The uncertainty surrounding trade policies has further complicated the market landscape. Investors are wary of how these tensions might impact global supply chains and economic growth. Additionally, the upcoming interest rate decisions from the Federal Reserve and the European Central Bank, along with American inflation data, are expected to influence market sentiment. As the situation evolves, both tech and chip firms are feeling the pressure, with significant losses reported in markets like Tokyo.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.