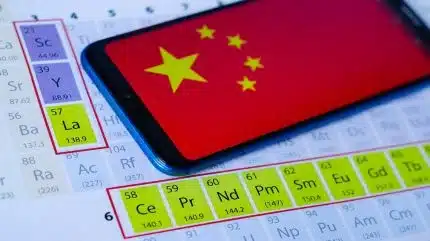

China’s Rare Earth Export Controls Escalate Trade Tensions

As the trade conflict between China and the United States intensifies, China has implemented export controls on critical rare earth minerals, significantly impacting U.S. industries. This strategic move highlights America’s heavy reliance on these essential materials, prompting U.S. officials to seek ways to boost domestic production. The implications of these restrictions could reshape the ongoing trade war and affect various sectors, particularly defense and technology.

Understanding Rare Earth Elements

Rare earth elements (REEs) comprise a group of 17 chemically similar elements vital for manufacturing numerous high-tech products. Despite their name, these elements are not particularly rare in nature; rather, they are challenging to extract and purify. Elements like Neodymium, Yttrium, and Europium play crucial roles in various applications. For instance, Neodymium is essential for creating powerful magnets used in loudspeakers, computer hard drives, electric vehicle motors, and jet engines, making these devices smaller and more efficient.

Yttrium and Europium are integral to producing vibrant displays in televisions and computer screens. According to Thomas Kruemmer, Director of Ginger International Trade and Investment, “Everything you can switch on or off likely runs on rare earths.” These elements are also critical in medical technologies, such as MRI machines and laser surgery, as well as in defense applications.

China’s Dominance in Rare Earth Supply

China holds a near-monopoly on the extraction and refining of rare earth elements, controlling approximately 61% of global production and an astounding 92% of processing, as reported by the International Energy Agency (IEA). This dominance allows China to dictate which companies can access these vital resources, significantly impacting global supply chains.

The extraction and processing of rare earths are both costly and environmentally damaging. Additionally, these resources often contain radioactive elements, deterring many countries, including those in the European Union, from pursuing their production. China’s rise to dominance in this sector is attributed to decades of strategic government policies and investments, which have enabled it to undercut global competitors by prioritizing lower environmental standards and labor costs.

China’s Export Restrictions and Their Implications

In retaliation for U.S. tariffs, China has recently imposed restrictions on the export of seven rare earth minerals, particularly “heavy” rare earths, which are crucial for defense technologies. Effective April 4, companies must now obtain special export licenses to ship these minerals and magnets out of China. This move is significant, as heavy rare earths are less common and more challenging to process, making them highly valuable.

As a signatory to the Non-Proliferation of Nuclear Weapons treaty, China can control the trade of dual-use products, which adds another layer of complexity to the situation. The Centre for Strategic and International Studies (CSIS) warns that these restrictions leave the U.S. particularly vulnerable, as there is currently no capacity outside of China to process heavy rare earths.

Potential Impact on the U.S. Economy and Defense

A recent U.S. Geological report indicates that between 2020 and 2023, the U.S. relied on China for 70% of its rare earth imports. The new export restrictions could severely impact U.S. industries, particularly in defense, where heavy rare earths are essential for technologies like missiles, radar systems, and advanced aircraft. The CSIS highlights that critical defense systems, including F-35 jets and Tomahawk missiles, depend on these minerals.

As China accelerates its military production and technological advancements, the U.S. faces significant challenges. The potential shortages and production delays in the defense and high-tech sectors could lead to increased prices for critical materials, affecting everything from smartphones to military hardware. In response to these challenges, President Trump has ordered an investigation into the national security risks posed by the U.S.’s reliance on foreign critical minerals, emphasizing their importance for national security and economic resilience.

Can the U.S. Increase Domestic Production?

Currently, the U.S. has one operational rare earth mine, but it lacks the capacity to separate heavy rare earths, necessitating the shipment of ore to China for processing. Historically, the U.S. was the largest producer of rare earths until the 1980s, when companies exited the market due to China’s competitive pricing and scale. This has led to a renewed interest in securing alternative sources, such as potential deals with Ukraine and Greenland, which holds significant rare earth reserves.

However, the U.S. faces a dual challenge: alienating China, the primary supplier of rare earths, while also straining relationships with other nations that could serve as alternative partners. The future of U.S. collaboration with these countries remains uncertain amid ongoing trade tensions and tariffs, raising questions about the nation’s ability to diversify its supply chains effectively.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.

Follow Us on Twitter, Instagram, Facebook, & LinkedIn