Celebrating Nine Years of PMFBY: A Farmer’s Safety Net

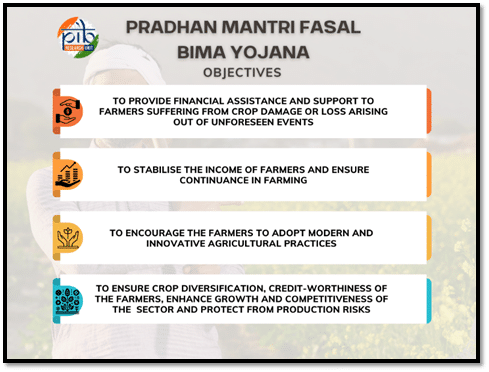

On February 18, 2025, the Pradhan Mantri Fasal Bima Yojana (PMFBY) will celebrate its nine-year anniversary. Launched in 2016 by Prime Minister Narendra Modi, this scheme has significantly empowered farmers across India. It provides a comprehensive safety net against crop losses caused by unpredictable natural disasters. By stabilizing farmers’ income, PMFBY encourages them to adopt innovative agricultural practices. The scheme is a crucial risk mitigation tool, offering financial support to farmers facing crop damage from various natural calamities, including droughts, floods, hailstorms, and pest attacks.

The success of PMFBY has led to its continuation, with the Union Cabinet approving its extension until 2025-26. The total budget allocated for this initiative is ₹69,515.71 crore. This funding ensures that farmers remain protected and supported in their agricultural endeavors. The scheme’s significance is further enhanced by the Restructured Weather Based Crop Insurance Scheme (RWBCIS), which operates alongside PMFBY. While both schemes aim to protect farmers, they differ in their methodologies for calculating claims.

Technological Advancements in PMFBY

The Pradhan Mantri Fasal Bima Yojana has embraced modern technology to enhance its effectiveness. The scheme utilizes advanced tools such as satellite imagery, drones, and remote sensing. These technologies play a vital role in crop area estimation and resolving yield disputes. By promoting the use of remote sensing, PMFBY improves the planning of Crop Cutting Experiments (CCEs), yield estimation, and loss assessment.

The integration of technology ensures greater transparency and accountability in the assessment of crop losses. For instance, the CCE-Agri App allows for direct data upload to the National Crop Insurance Portal (NCIP). This feature enables insurance companies to monitor the conduct of CCEs effectively. Additionally, the introduction of the Yield Estimation System Based on Technology (YES-TECH) aims to streamline yield loss assessments. This system blends technology-based estimates with manual assessments, gradually reducing reliance on traditional methods.

These technological advancements not only enhance the accuracy of loss assessments but also facilitate timely payment of claims. By leveraging technology, PMFBY aims to create a more efficient and transparent insurance process for farmers.

Key Benefits of PMFBY

The Pradhan Mantri Fasal Bima Yojana offers several key benefits that make it an essential support system for farmers. One of the most significant advantages is the affordability of premiums. Farmers pay a maximum premium of 2% for Kharif food and oilseed crops, 1.5% for Rabi crops, and 5% for commercial or horticultural crops. The government subsidizes the remaining premium, making it accessible to a broader range of farmers.

Moreover, PMFBY provides comprehensive coverage against various risks. It protects farmers from natural disasters such as droughts and floods, as well as pests and diseases. The scheme also covers post-harvest losses due to local risks like hailstorms and landslides. Timely compensation is another critical feature of PMFBY. The scheme aims to process claims within two months of harvest, ensuring that farmers receive compensation quickly and can avoid falling into debt traps.

Additionally, the integration of advanced technologies ensures precise estimation of crop losses. This technology-driven implementation enhances the accuracy of claim settlements, providing farmers with a reliable safety net.

Strengthening the PMFBY Framework

Since its inception in 2016, the government has made significant efforts to enhance transparency and accountability within the Pradhan Mantri Fasal Bima Yojana. These interventions have resulted in a substantial increase in the number of farmers and areas covered under the scheme. As of 2023-24, PMFBY has become the largest crop insurance scheme in the world in terms of farmer applications.

One notable aspect of PMFBY is its voluntary nature. Despite being optional, the coverage for non-loanee farmers has risen to 55% of the total coverage under the scheme. This increase reflects the growing trust and acceptance of PMFBY among farmers. Some states have even waived the farmers’ share of the premium, further reducing the financial burden on them.

The government continues to explore ways to improve the scheme, ensuring that it remains relevant and beneficial for farmers. As PMFBY moves forward, it aims to empower farmers and strengthen the resilience of India’s agricultural sector.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.