Understanding the New Income Tax Slabs for FY 2025-26

The Indian government has introduced revised income tax slabs for the financial year 2025-26. Finance Minister Nirmala Sitharaman announced these changes during her Union Budget 2025 speech. The most significant highlight is that individuals earning up to Rs 12 lakh will now pay zero tax. This change aims to provide relief to middle-class taxpayers and stimulate economic growth. The new tax regime also includes lower tax rates for individuals earning above Rs 12 lakh, making it a crucial update for taxpayers across various income brackets.

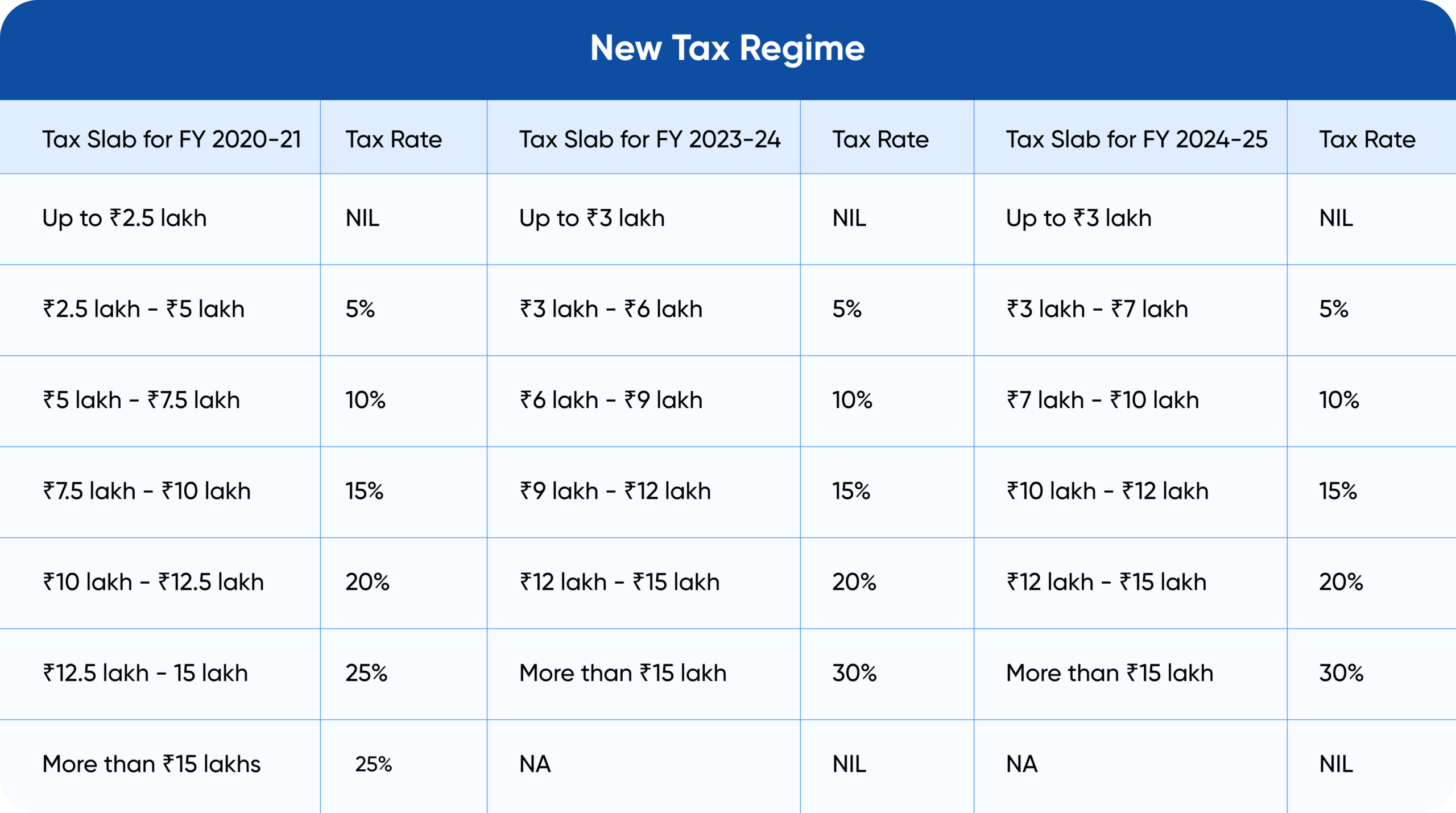

Key Changes in Income Tax Slabs

The new income tax slabs for FY 2025-26 have been designed to benefit a wide range of taxpayers. Under the revised structure, individuals earning up to Rs 12 lakh will not have to pay any tax. This is a significant increase from the previous threshold of Rs 7 lakh. For salaried individuals, the standard deduction of Rs 75,000 raises the effective income limit to Rs 12.75 lakh, allowing them to enjoy tax-free income.

For those earning above Rs 12 lakh, the tax rates have been adjusted to ensure lower tax liabilities. For instance, a taxpayer with an income of Rs 12 lakh will save Rs 80,000 in taxes compared to the previous regime. Similarly, individuals earning Rs 18 lakh will benefit from a tax reduction of Rs 70,000, while those with an income of Rs 25 lakh will save Rs 1.1 lakh. This progressive structure aims to ease the financial burden on taxpayers while encouraging compliance with tax regulations.

Understanding Marginal Relief

One of the noteworthy features of the new tax regime is the introduction of marginal relief. This provision is designed to protect individuals whose income slightly exceeds the Rs 12 lakh threshold. For example, if a taxpayer earns Rs 12.1 lakh, they would typically face a tax liability of Rs 61,500. However, with marginal relief, the tax payable is reduced to Rs 10,000. This ensures that taxpayers do not face a disproportionate tax burden for earning just above the tax-free limit.

Marginal relief is calculated by comparing the tax liability without relief to the amount exceeding the Rs 12 lakh threshold. This approach ensures that taxpayers retain a significant portion of their income, even if they earn slightly above the exempt limit. The introduction of this relief mechanism is a welcome change for many taxpayers who may have previously faced steep tax increases due to minor income fluctuations.

FAQs on the New Tax Regime

Many taxpayers have questions regarding the new income tax slabs and their implications. Here are some frequently asked questions:

- What is the New Regime?

The new regime offers lower tax rates and broader slabs but does not allow most deductions. - Who benefits from the new slabs?

The changes benefit individuals, Hindu Undivided Families (HUFs), and associations of persons. - How does the standard deduction work?

A standard deduction of Rs 75,000 is available, allowing salaried individuals to earn up to Rs 12.75 lakh tax-free. - What is the maximum income for NIL tax?

The maximum income for which tax liability is NIL has been raised to Rs 12 lakh. - How many taxpayers will benefit?

Approximately 1 crore taxpayers who previously paid taxes will now benefit from the new slabs.These changes reflect the government’s commitment to easing the tax burden on individuals and promoting economic growth. Taxpayers are encouraged to understand the new regime and assess how it impacts their financial planning for the upcoming fiscal year.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.