India’s Smartphone Market Trends in 2024

The smartphone market in India is undergoing significant changes. In 2024, the premium segment saw remarkable growth, while budget and midrange categories faced challenges. According to a report by CyberMedia Research (CMR), the premium smartphone market grew by 36 percent year-on-year. Samsung emerged as the leading brand in this segment, while Apple made notable gains. The report also highlighted a decline in 2G smartphones and a mixed performance in the budget and midrange segments. This article explores the key trends and shifts in the Indian smartphone market for 2024.

Premium Smartphone Market Thrives

The premium smartphone market in India, defined as devices priced between Rs. 25,000 and Rs. 50,000, experienced a robust growth of 36 percent in 2024. The super-premium segment, which includes smartphones priced between Rs. 50,000 and Rs. 1 lakh, also saw a 10 percent increase. The uber-premium segment, featuring devices over Rs. 1 lakh, rose by an impressive 25 percent. This growth indicates a strong consumer preference for high-end devices.

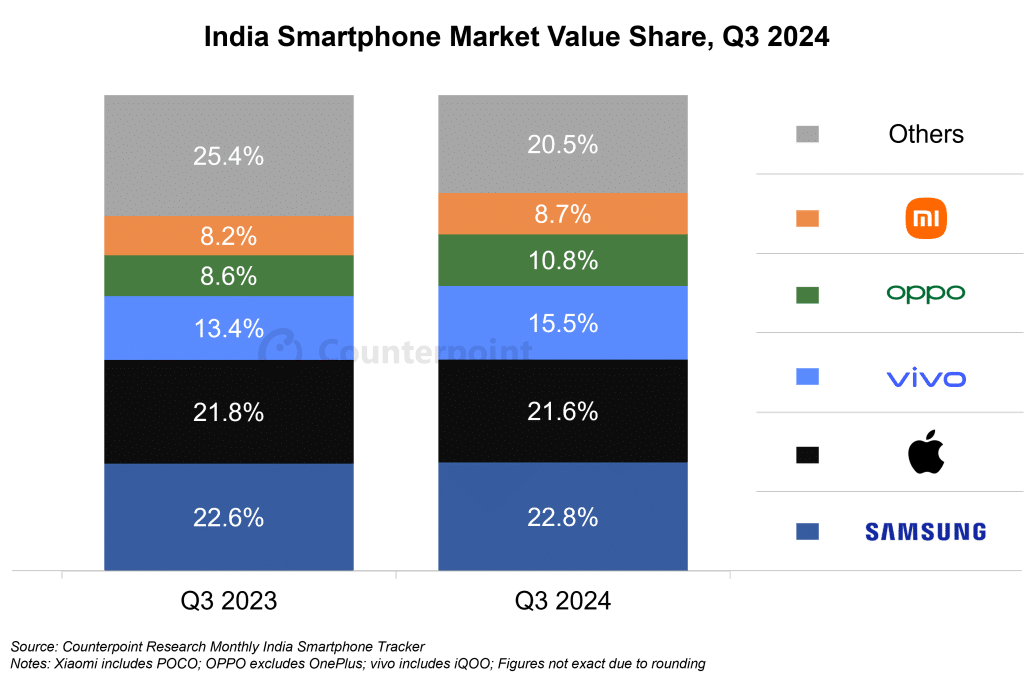

Apple was the standout performer in the premium segment, achieving a remarkable 72 percent year-on-year increase in market share during the last quarter of 2024. This surge allowed Apple to break into the top five smartphone brands in India. Samsung maintained its position as the top brand in the premium market, holding a 28 percent share. Vivo followed closely, capturing 15 percent of the market. The competition among these brands is fierce, with each striving to innovate and attract consumers.

In the 5G smartphone market, Vivo led with a 19 percent share in Q4 2024, closely followed by Samsung at 18 percent. Xiaomi, including its sub-brand Poco, emerged as the overall top smartphone maker in India, achieving an 18 percent market share. This competitive landscape highlights the dynamic nature of the Indian smartphone market, where brands are continuously adapting to consumer preferences and technological advancements.

Decline of Feature Phones and 4G Handsets

The decline of feature phones and 4G smartphones is a notable trend in the Indian market. In Q4 2024, the 4G smartphone segment experienced a staggering 59 percent drop year-on-year. Similarly, feature phones with 2G connectivity saw a decline of 22 percent. This shift reflects changing consumer preferences as more users opt for advanced smartphones with better features and connectivity options.

Despite the overall decline in these segments, budget smartphones priced under Rs. 7,000 saw a slight growth of 1 percent over the past year. This indicates that while consumers are moving towards premium devices, there remains a demand for affordable options. In Q4 2024, Vivo led the budget smartphone market with an 18 percent share, driven by models like the Vivo T3x 5G and Vivo Y28s 5G. Xiaomi followed closely with 15.2 percent, boosted by the popularity of its Redmi series.

Interestingly, the brand Nothing, led by Carl Pei, experienced explosive growth of over 800 percent in the last quarter. This surge was attributed to the success of the Nothing Phone 2a series and products from its sub-brand, CMF. The rise of new players like Nothing indicates a shift in consumer interest towards innovative and unique offerings in the smartphone market.

Future Outlook and Innovations

As the Indian smartphone market evolves, experts predict continued growth in the premium segment. Pankaj Jadli, an analyst at CMR, emphasizes that the premium market, defined as smartphones priced above INR 25,000, will thrive due to rising consumer demand. Smartphone manufacturers are expected to shift their strategies from hardware-centric approaches to those focused on generative AI (GenAI) features. This transition will cater to the growing demand for advanced technology in smartphones.

In 2024, Qualcomm’s Snapdragon chips powered one in three premium smartphones, while MediaTek-equipped devices captured a significant 52 percent market share. The integration of generative AI features into midrange and high-end smartphones is becoming increasingly common. This trend indicates that consumers are looking for more than just basic functionalities; they want smart devices that enhance their daily lives.

Looking ahead to 2025, CMR predicts that smartphone shipments will likely see single-digit growth. This forecast suggests that while the market is maturing, there is still potential for innovation and growth. Manufacturers will need to focus on value-for-money offerings and affordable smartphones to meet the demands of the mass market. As the landscape continues to change, brands that adapt quickly to consumer needs will likely emerge as leaders in the competitive Indian smartphone market.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.