Federal Reserve’s Potential Rate Cuts in 2023

The U.S. Federal Reserve is considering multiple interest rate cuts this year, depending on inflation data. A senior bank official indicated that the Fed could lower rates three to four times if inflation trends favorably. The first cut might happen before July. This news comes as inflation data shows mixed signals, with headline consumer inflation rising due to increased energy prices. However, a closely monitored measure of inflation has eased slightly, suggesting that underlying inflation may be stabilizing.

Recent Inflation Trends

In December, the U.S. experienced a rise in headline consumer inflation for the third consecutive month. This increase was primarily driven by higher energy prices. However, the core inflation measure, which excludes food and energy costs, showed signs of moderation. Fed Governor Christopher Waller expressed optimism about the inflation data, stating that the underlying price pressures are nearing the Fed’s target. He noted that this could pave the way for potential rate cuts.

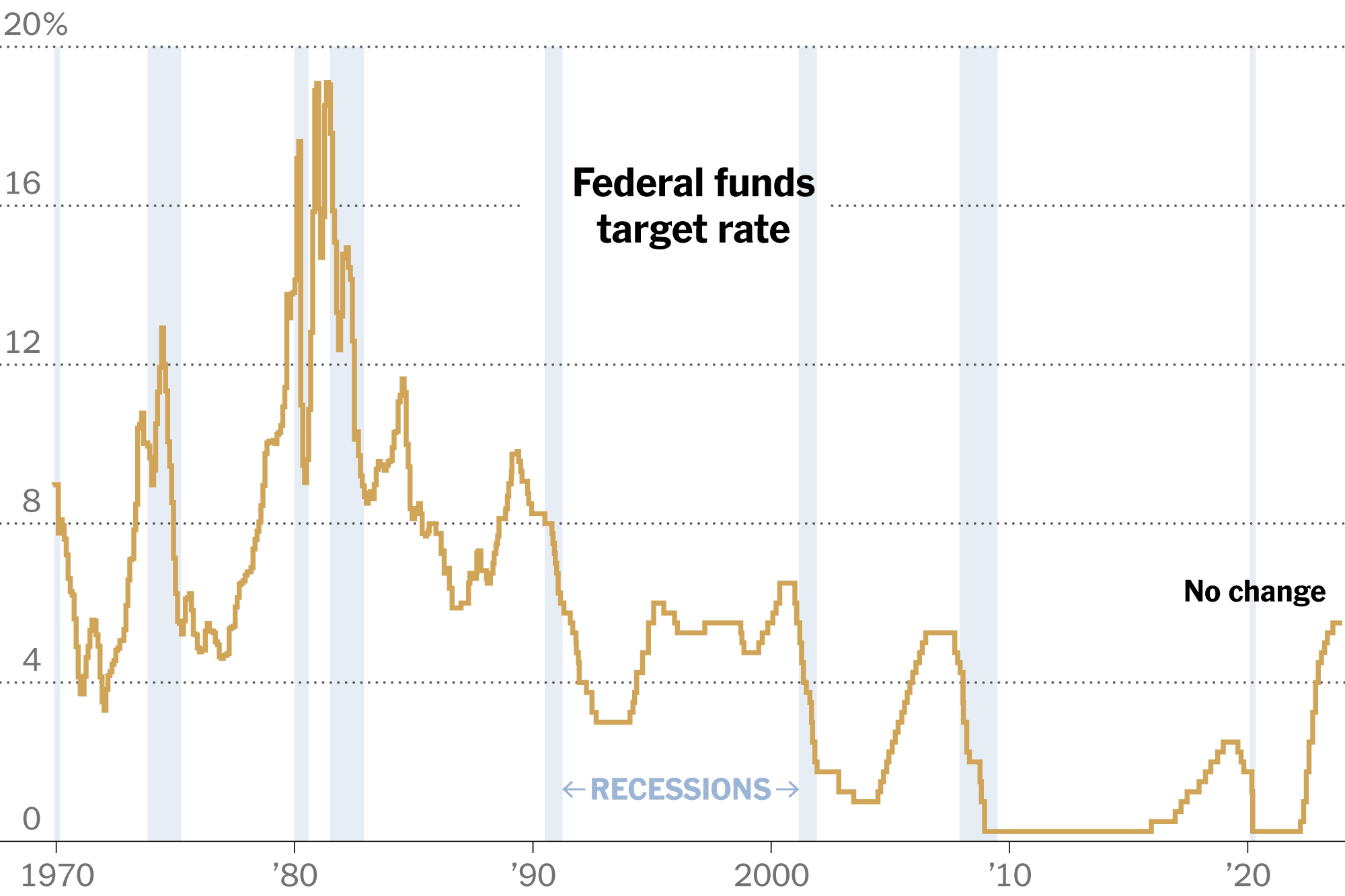

The Federal Reserve has been actively reducing interest rates in recent months. Since September, rates have been cut by a full percentage point to support the labor market. Despite these cuts, recent inflation trends have raised concerns among policymakers. At the last rate decision in December, the Fed lowered rates by a quarter percentage point, bringing them to a range of 4.25% to 4.50%. Initially, the Fed had anticipated only two rate cuts for the year. However, Waller’s comments suggest a more aggressive approach may be on the table if inflation data continues to improve.

Future Rate Cut Possibilities

Waller indicated that he could support as many as four rate cuts this year, contingent on favorable data. He expressed a more optimistic view on inflation trends compared to some of his colleagues. If the data aligns with his expectations, he believes it is reasonable to anticipate rate cuts in the first half of the year. He did not rule out the possibility of a cut as soon as the Fed’s March meeting, depending on the data available at that time.

Market expectations currently suggest a 70% chance that the Fed will maintain its current rates through the March decision. Additionally, futures traders estimate an 80% probability of no more than two cuts this year. This indicates a cautious approach from the market, contrasting with Waller’s more aggressive outlook. The divergence in views highlights the uncertainty surrounding inflation and its impact on monetary policy.

Impact of Tariff Proposals on Inflation

Waller also addressed concerns regarding potential inflationary impacts from President-elect Donald Trump’s tariff proposals. These proposals include significant tariffs on goods entering the United States, which some economists believe could lead to short-term price increases. However, Waller downplayed the likelihood of tariffs having a lasting effect on inflation. He stated that most analysts expect any impact to be marginal and temporary.

While Trump and his supporters argue that tariffs will not significantly affect prices, Waller emphasized the need for careful observation. He acknowledged that the economic landscape is complex and that the effects of tariffs could vary. Ultimately, he believes that the Fed’s focus should remain on the broader economic indicators rather than short-term fluctuations caused by policy changes.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.