Understanding India’s Tax Regimes: Old vs. New

As India prepares for the Budget 2025, a pressing question looms over taxpayers: Will the old tax regime be abolished? Currently, the Indian income tax system offers two distinct regimes: the old regime, which includes various exemptions and deductions, and the new regime, which features simplified tax rates but fewer benefits. This article delves into the nuances of both tax regimes, their implications for taxpayers, and the ongoing debate surrounding potential changes.

Overview of the Tax Regimes

India’s income tax structure has evolved significantly over the years. The old tax regime allows taxpayers to claim numerous exemptions and deductions, making it appealing for those who have significant expenses. In contrast, the new tax regime, introduced in the financial year 2020-21, simplifies the tax process with lower rates but limits the benefits available to taxpayers.

Under the new regime, taxpayers can enjoy concessional slab rates on income up to Rs 15 lakh. For instance, individuals earning up to Rs 7 lakh can claim a rebate under Section 87A of up to Rs 25,000. In comparison, the old regime offers a rebate of Rs 12,500 for total incomes not exceeding Rs 5 lakh. Additionally, the new regime provides a revised standard deduction of Rs 75,000 for salaried taxpayers, while the old regime offers a standard deduction of Rs 50,000.

However, the new regime’s appeal diminishes for individuals who rely on various deductions, such as House Rent Allowance (HRA) and Leave Travel Allowance (LTA). Taxpayers must weigh the benefits of lower rates against the loss of these deductions when deciding which regime to choose.

Tax Slab Rates: A Comparative Analysis

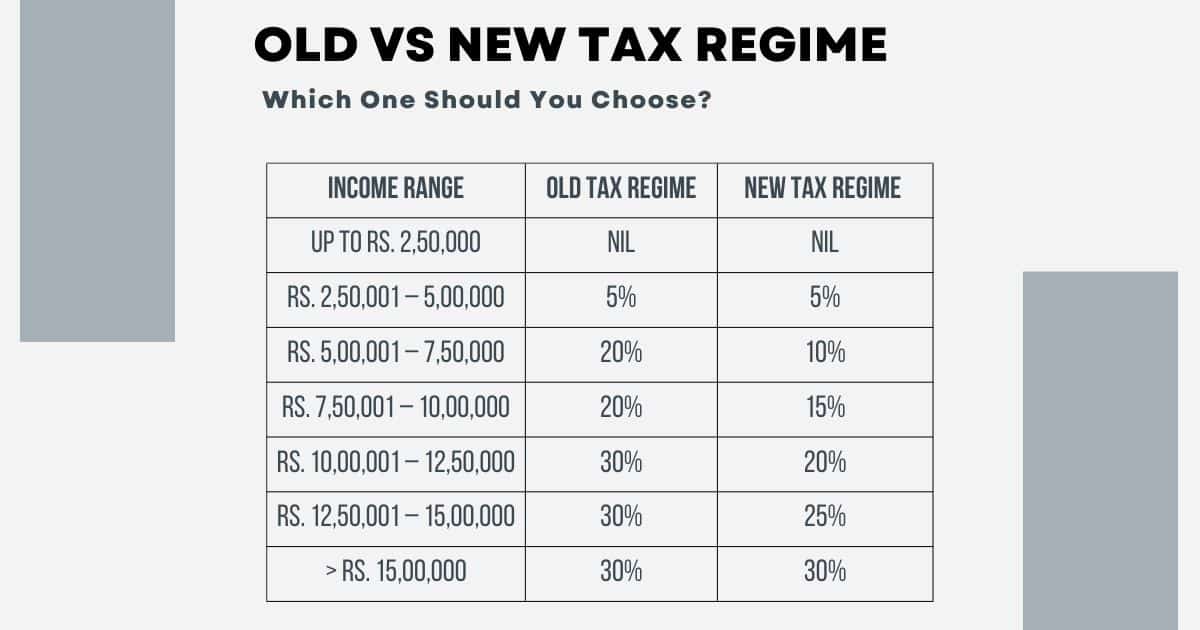

Understanding the tax slab rates is crucial for taxpayers navigating the old and new regimes. The old tax regime features a tiered structure where income up to Rs 2.5 lakh is tax-free. Income between Rs 2.5 lakh and Rs 5 lakh is taxed at 5%, while income from Rs 5 lakh to Rs 10 lakh is taxed at 20%. For incomes exceeding Rs 10 lakh, the tax rate is 30%.

Conversely, the new tax regime has adjusted the income slabs. Income up to Rs 3 lakh is tax-free, and the 5% tax rate applies to income between Rs 3 lakh and Rs 7 lakh. The rates continue to increase, with 10% for income between Rs 7 lakh and Rs 10 lakh, and 20% for income between Rs 10 lakh and Rs 12 lakh. The maximum rate of 30% applies to incomes exceeding Rs 15 lakh.

This comparison highlights that while the new regime offers lower rates for certain income brackets, it also eliminates many deductions that could benefit taxpayers in the old regime. Therefore, individuals without significant deductions may find the new regime more advantageous, while those with substantial deductions may prefer the old regime.

The Case for Deductions in the New Regime

Despite the benefits of the new tax regime, many tax experts argue for the inclusion of specific deductions. One significant area of concern is the lack of deductions for medical insurance premiums under Section 80D. Currently, taxpayers cannot claim deductions for medical insurance premiums in the new regime, which is a vital expense for many families.

Experts advocate for allowing these deductions, as medical expenses are often unavoidable. Kinjal Bhuta, a chartered accountant, emphasizes that while the new regime encourages savings and investments, health-related expenses should not be overlooked. Allowing deductions for medical insurance premiums would provide essential financial relief to taxpayers.

Additionally, the absence of deductions for individuals with disabilities under Section 80U has raised concerns. This section provides monetary relief based on the degree of disability, offering deductions of Rs 75,000 for moderate disabilities and Rs 1.25 lakh for severe disabilities. Vishesh Sangoi, a partner at DPS & Co, argues that removing these deductions under the new regime undermines the financial support intended for individuals with disabilities.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.