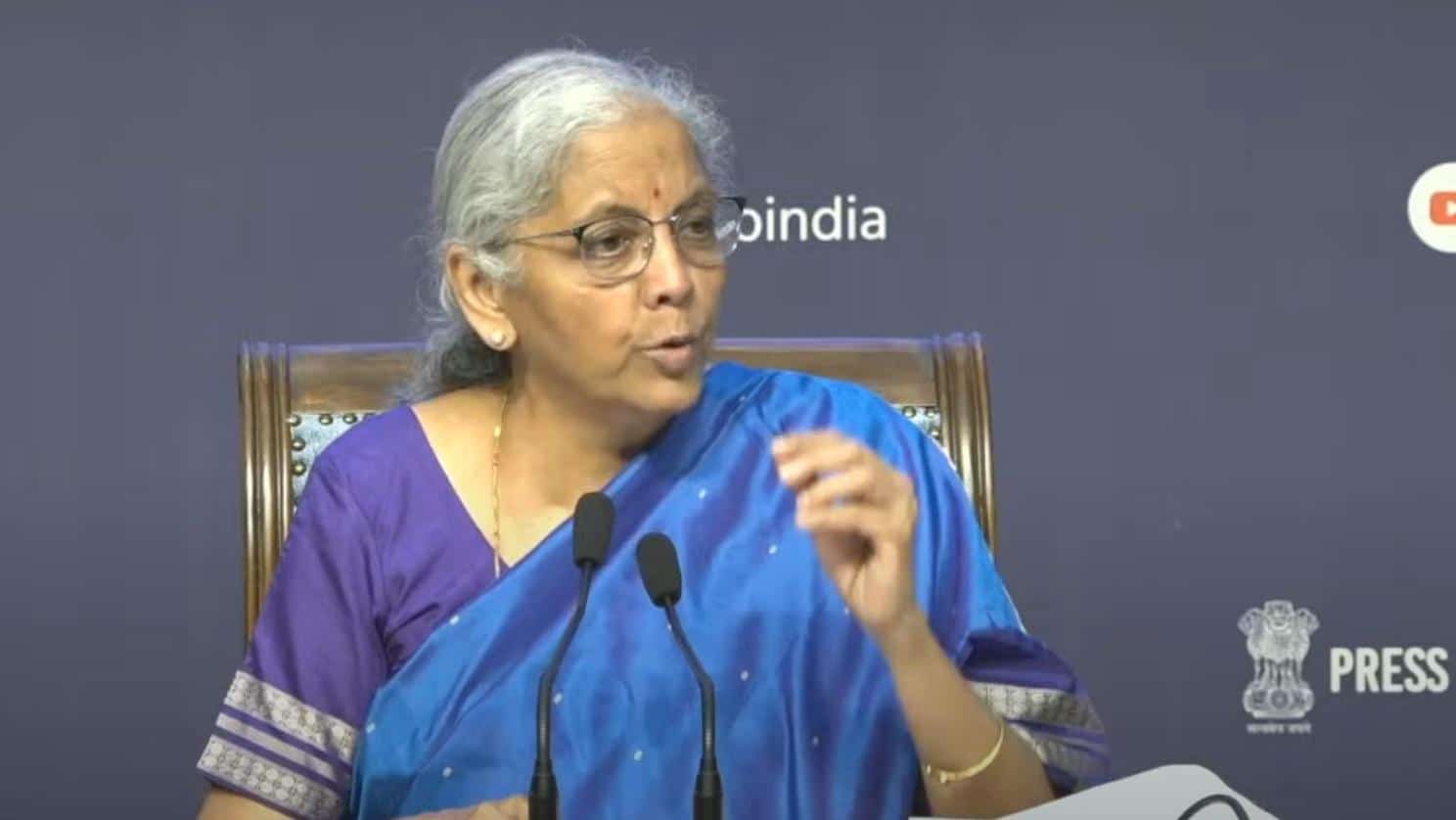

FM Sitharaman Highlights GST Rate Cuts: Reforms Expected to Infuse Rs 2 Lakh Crore into Economy

Finance Minister Nirmala Sitharaman announced significant changes to the Goods and Services Tax (GST) during an Outreach and Interaction Program on Next Gen GST Reforms. Effective September 22, the Modi government will implement GST rate cuts that are expected to inject ₹2 lakh crore into the economy. The new tax regime simplifies the structure to just two slabs—5% and 18%—which will provide consumers with more cash in hand. Sitharaman emphasized that these reforms will benefit a wide range of sectors and consumers alike.

Impact of GST Rate Cuts

The recent GST rate cuts are poised to have a substantial impact on the Indian economy. According to Finance Minister Nirmala Sitharaman, the new tax structure will inject ₹2 lakh crore into the economy. This change is part of a broader effort to simplify the tax system and enhance consumer spending. The minister highlighted that 99% of items previously taxed at 12% will now fall under the 5% category, while 90% of items that were taxed at 28% will shift to the 18% slab. This restructuring is expected to lower prices for consumers, particularly in the run-up to the festive season.

Sitharaman noted that many companies, especially in the fast-moving consumer goods (FMCG) sector, are proactively reducing their prices to pass on the benefits of the new GST rates to consumers. This move is seen as a “Diwali gift” for the public, aimed at boosting consumer confidence and spending during a crucial time of the year.

Criteria for Implementing Rate Changes

The government took into account five essential criteria before implementing the GST rate changes. These include providing relief to poor and middle-class citizens, addressing the aspirations of the middle class, supporting farmers, favoring micro, small, and medium enterprises (MSMEs), and focusing on sectors that are vital for employment generation and export potential. Sitharaman emphasized that these criteria reflect the government’s commitment to inclusive economic growth.

The minister also pointed out the impressive growth in GST revenue, which reached ₹22.08 lakh crore in 2025, a significant increase from ₹7.19 lakh crore in the fiscal year 2017-18. This growth is indicative of the effectiveness of the GST system in broadening the tax base and enhancing compliance among taxpayers.

Taxpayer Registration and Cooperative Federalism

Sitharaman reported a remarkable increase in taxpayer registrations, which surged to 1.51 crore from just 65 lakh previously. This increase demonstrates the success of the GST framework in encouraging compliance and expanding the tax net. The minister underscored that the GST Council is the only constitutional body established post-independence, serving as a model of cooperative federalism in India.

In her remarks, Sitharaman criticized the previous UPA government’s tax framework, describing it as problematic and ineffective. She noted that the UPA struggled for a decade to implement GST, highlighting the extensive efforts made by the current government to establish a unified national tax system. The simplification of the GST structure, reducing the number of tax slabs from four to two, is a significant step toward making the tax system more efficient and user-friendly.

Future of GST in India

The upcoming changes to the GST structure are expected to streamline tax compliance and enhance the ease of doing business in India. By reducing the number of tax slabs and simplifying the overall framework, the government aims to create a more favorable environment for both consumers and businesses. The implementation of the new GST rates on September 22 marks a pivotal moment in India’s tax reform journey.

As the government prepares for these changes, stakeholders across various sectors are closely monitoring the developments. The anticipated benefits of the new GST regime are expected to resonate throughout the economy, potentially leading to increased consumer spending and economic growth in the months ahead.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.

Follow Us on Twitter, Instagram, Facebook, & LinkedIn