GST Rationalisation to Benefit Road Transport and Auto Sector

The GST Council, led by the Union Finance and Corporate Affairs Minister, has made significant changes to the Goods and Services Tax (GST) rates for the road transport and automobile sectors during its 56th meeting. This reform aims to provide tax relief for various vehicles, including two-wheelers, cars, tractors, buses, and commercial vehicles, making them more affordable. The adjustments are expected to enhance logistics efficiency, stimulate demand in both urban and rural markets, and support the growth of micro, small, and medium enterprises (MSMEs) within the auto-component supply chain.

Driving Growth in the Automobile Sector

The recent GST rate reductions across different categories of vehicles and auto components are set to transform the automobile industry. This initiative will benefit a wide range of stakeholders, including manufacturers, ancillary industries, MSMEs, farmers, transport operators, and millions of workers in both formal and informal sectors. The key impacts of these changes include lower prices for two-wheelers, small cars, tractors, buses, and trucks, which are expected to drive higher demand and subsequently create jobs in manufacturing, sales, logistics, and services.

Additionally, the reforms are anticipated to facilitate the expansion of credit-driven vehicle purchases through non-banking financial companies (NBFCs), banks, and fintech firms. The move aligns with national initiatives like Make in India and PM Gati Shakti, aiming to improve manufacturing competitiveness and promote cleaner mobility. By simplifying and stabilizing the tax framework, the government seeks to support farmers and transport operators while reinforcing the overall growth of the sector.

Sector-Wise GST Rate Changes

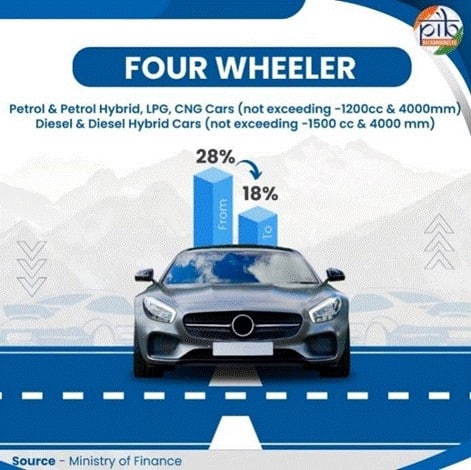

The GST Council’s decision includes specific changes to the tax rates for various vehicle categories. For instance, the GST rate for two-wheelers has been reduced from 28% to 18%, making mobility more affordable for youth and rural households. Similarly, small cars will see a decrease in GST from 28% to 18%, encouraging first-time buyers and boosting sales in smaller towns.

Larger vehicles, such as commercial goods vehicles and buses with more than ten seats, will also benefit from reduced GST rates, dropping from 28% to 18%. This change is expected to lower freight costs, reduce inflationary pressures, and strengthen supply chains. Tractors, which previously had a GST rate of 12%, will now be taxed at just 5%, reinforcing India’s position as a global tractor hub and promoting farm mechanization. The overall adjustments aim to create a more favorable environment for consumers and businesses alike.

Benefits Across the Ecosystem

The GST rationalization is poised to deliver widespread benefits across the automotive ecosystem. It is projected to support over 3.5 crore jobs in the auto and allied sectors, creating a multiplier effect on small businesses involved in manufacturing tyres, batteries, glass, steel, plastics, and electronics. The reforms will also provide more opportunities for drivers, mechanics, gig workers, and service providers, enhancing employment prospects in the industry.

Moreover, the initiative promotes cleaner and safer mobility by incentivizing the replacement of older, polluting vehicles with more fuel-efficient models. It encourages the adoption of public transport, which can help reduce congestion and emissions in urban areas. The reforms are also expected to strengthen logistics and exports by lowering freight rates, thereby enhancing the competitiveness of Indian goods in global markets.

Conclusion and Implementation Timeline

The GST rationalization represents a significant milestone in India’s pursuit of affordable, efficient, and sustainable mobility. By lowering the tax burden on vehicles and auto components, the reform not only benefits consumers but also strengthens the automotive ecosystem, supports MSMEs, and boosts employment opportunities across urban and rural India. Effective from September 22, 2025, these reforms reaffirm India’s commitment to a simpler, fairer, and growth-oriented GST framework, ensuring improved living standards for citizens and facilitating business operations for enterprises.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.