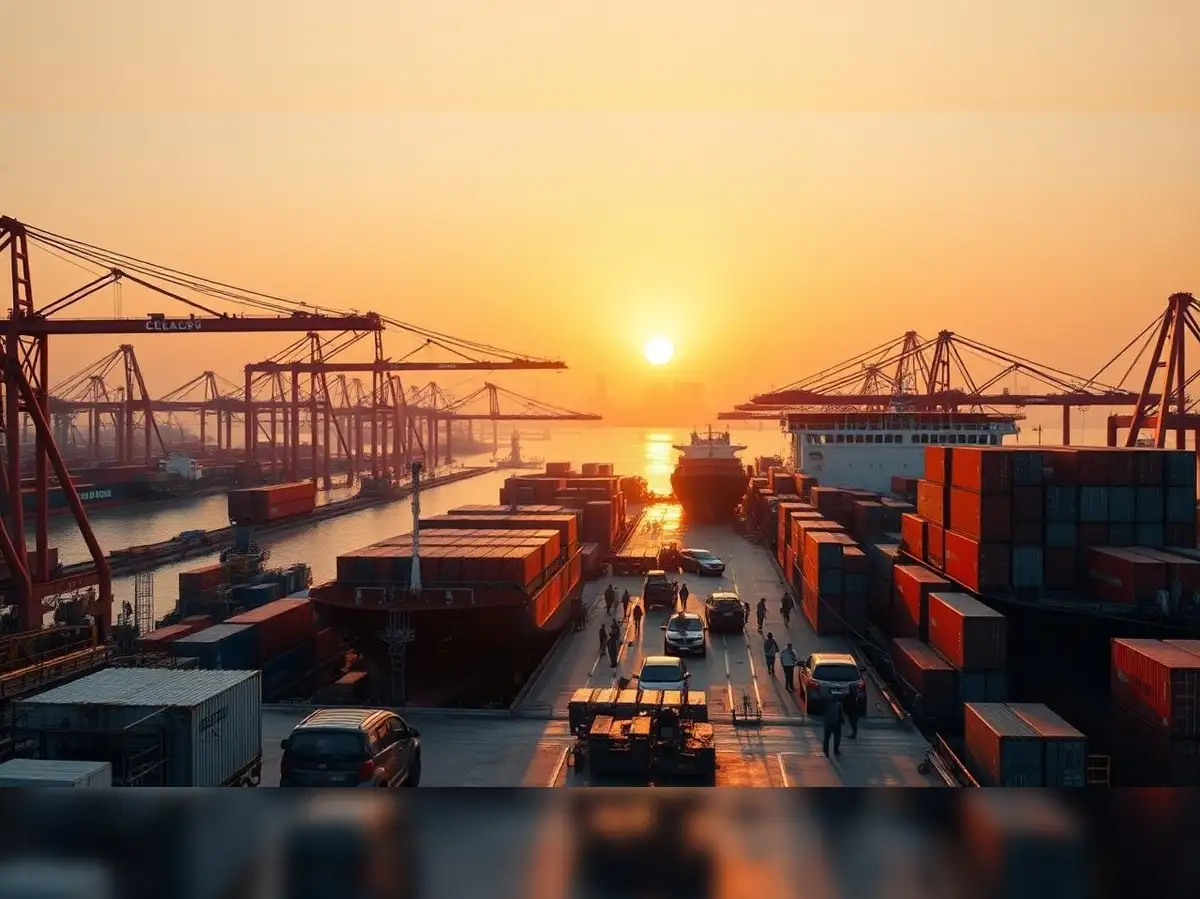

India’s Trade Gap: Merchandise Deficit Narrows to $20 Billion

India’s merchandise trade deficit has shown a slight improvement, narrowing to $20.7 billion in June 2025 from $21.9 billion in May, as reported by the Union Bank of India (UBI). This positive shift is attributed to a decrease in crude oil prices, reduced gold imports, and strategic changes in sourcing. The report highlights a temporary drop in global oil prices following a ceasefire between Israel and Iran, which, along with increased oil production by OPEC+, has contributed to a more favorable trade balance for India.

Crude Oil Imports and Trade Balance

India’s crude oil imports experienced a minor decline in June, averaging 4.66 million barrels per day, down from 4.72 million barrels per day in May, according to Vortexa data. The decrease in imports is linked to a strategic shift in sourcing, with refiners increasing purchases from Russia and the United States, surpassing traditional suppliers in the Middle East. Notably, imports from Russia reached a two-year high of 2–2.2 million barrels per day, while shipments from the U.S. surged over 270% year-on-year during the first four months of 2025. This shift is driven by the availability of discounted Russian oil and a desire for diversification, which also reduces geopolitical risks associated with the Strait of Hormuz. However, India’s petroleum exports fell nearly 10% in June, dropping to 1.19 million barrels per day from 1.32 million barrels per day in May, limiting the overall improvement in the trade balance.

Gold Imports and Domestic Demand

Gold imports into India also saw a decline, contributing to a narrower gold trade deficit. This reduction is attributed to soaring global prices, stricter government regulations, and increased recycling activities. In June, average gold prices reached $3,353 per ounce, reflecting a 5% month-on-month increase and a 32% rise since the beginning of the year. Domestic demand for gold remained subdued, with imports falling to 30.56 tonnes in May from 34.87 tonnes in April, and expectations suggest a further dip in June. The tightening of gold imports is part of a broader strategy to manage the trade deficit effectively.

Coal Imports and Trade Regulations

In June, India imported 16.59 million tonnes of coal through major ports, marking a 1.2% increase compared to the previous year, but a 2.1% decrease from May. Thermal coal constituted over 70% of this volume, with a year-on-year increase of 7.2%. In response to ongoing trade violations and diplomatic shifts, the Indian government has introduced anti-dumping duties on four chemicals imported from China and has prohibited imports of jute and woven fabrics from Bangladesh. Additionally, Indian producers of iron ore pellets are advocating for restrictions on imports from Oman, raising concerns about Iranian-linked cargoes affecting domestic markets.

Future Outlook on Trade Deficit

Looking ahead, the UBI report emphasizes the need to closely monitor commodity prices, particularly for oil and metals, to assess future trends in the trade deficit. If prices continue to rise, India’s import bill could face pressure in the coming months. However, the report also notes that softening global demand and sluggish export performance may help mitigate the overall impact on the trade balance. As the situation evolves, stakeholders will need to remain vigilant to navigate the complexities of international trade dynamics.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.

Follow Us on Twitter, Instagram, Facebook, & LinkedIn