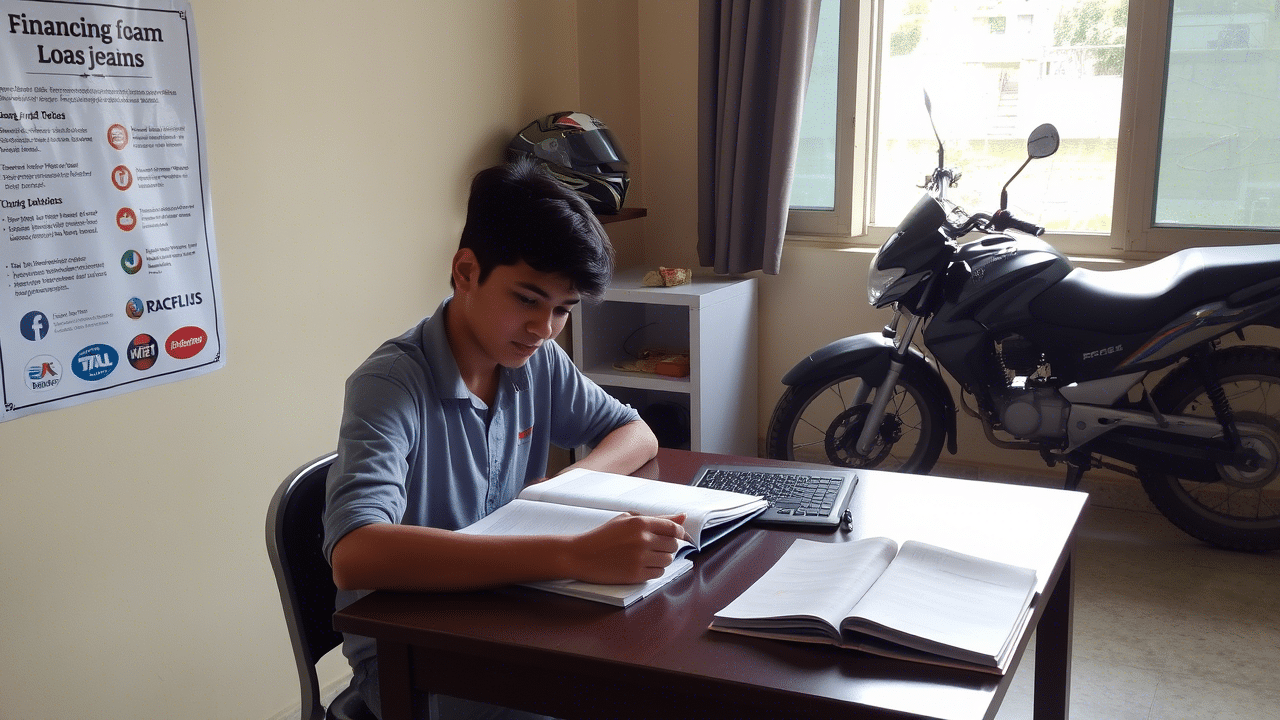

How to Get a Two-Wheeler Loan as a Student with No Income

An informative guide to help students navigate the process of getting a two-wheeler loan without a regular source of income.

Understanding the Basics of a Student Two-Wheeler Loan

Before applying, it’s important to know what a student two-wheeler loan means and why it’s useful. Here, you’ll learn the basics and its purpose for students.

What is a Student Two-Wheeler Loan

A student two wheeler loan is a financing option that helps students purchase a bike without paying the entire amount upfront. It allows them to own a two-wheeler by repaying the cost in smaller, affordable EMIs over time, making mobility easier even without a steady income.

Why Students May Need a Two-Wheeler Loan

Students often live away from home and depend on public transport, which can be unreliable or time-consuming. Owning a bike offers independence and saves travel time. A loan makes this possible by spreading the cost into manageable monthly payments, helping students from modest backgrounds afford personal transport.

Is It Possible to Get a Two-Wheeler Loan Without Income?

Getting a two-wheeler loan without income may seem difficult, but it’s not impossible. This section explains how students can still qualify through alternative routes.

What Lenders Typically Look For

Lenders generally require income proof, a stable job, and a good credit score to approve any loan. For students with no income, this can be a hurdle. However, lenders may still approve the loan if alternative conditions are met—such as adding a guarantor or co-applicant with a strong financial profile.

Role of a Co-Applicant or Guarantor

A co-applicant or guarantor, such as a parent or any financially stable family member, plays a key role in securing the loan. Their income and credit score help reassure the lender that the loan will be repaid, making it easier for students with no income to get approval.

Steps to Get a Student Two-Wheeler Loan

Applying for a student two-wheeler loan involves a few essential steps. This section outlines the process from choosing a bike to submitting your application:

Choose a Bike and Estimate the Loan Amount

Choose a two-wheeler that fits both your needs and your budget, avoiding expensive models that demand high down payments or lead to unmanageable EMIs. Estimate how much you can borrow based on your guarantor’s financial stability and willingness to support the loan.

Check Your Eligibility Criteria

Eligibility criteria vary by lender but typically include:

- Age between 18 and 25 years

- Indian citizenship

- Valid ID and address proof

- Co-applicant with income or creditworthiness

Use an EMI Calculator for Two-Wheeler Loan Planning

An EMI calculator for two wheeler loans helps you estimate your monthly repayments by entering the loan amount, tenure, and interest rate. It lets you adjust these values to find an EMI that suits your or your co-applicant’s budget, making financial planning easier before applying.

Gather Required Documents

Prepare the following documents:

- Aadhaar card or PAN card

- Student ID or college admission proof

- Passport-sized photographs

- Income proof of co-applicant (salary slips or ITRs)

- Bank statements of last 6 months

Apply Online Through a Trusted Financial Marketplace

Platforms like Bajaj Markets allow students to compare lenders and apply digitally. You can upload documents, check eligibility, and track your application in one place without visiting a bank.

Tips to Improve Loan Approval Chances as a Student

Getting a loan as a student without income can be tough, but not unachievable. This section shares practical tips to improve your chances of approval:

Maintain a Good Bank History

Even if you do not earn, having a bank account with regular transactions reflects financial discipline.

Try and avoid bounced cheques or overdrafts that may affect your co-applicant’s profile.

Add a Financially Stable Co-Borrower

Having a co-borrower with a consistent income and a good credit score significantly boosts loan approval chances. Ensure their credit history is clean and up to date.

Opt for a Lower Loan Amount Initially

Applying for a small loan amount reduces the lender’s risk. Start small, repay responsibly, and you may be eligible for a higher loan in the future.

Build a Small Fixed Deposit if Possible

A fixed deposit can serve as collateral for a secured bike loan, helping you prove repayment capacity while earning interest on the deposit at the same time.

Understanding Your Repayment: Using an EMI Calculator

Knowing your repayment amount in advance is essential for budgeting. This section explains how an EMI calculator can help you plan a two-wheeler loan wisely.

Why EMI Planning is Crucial for Students

As a student, every rupee counts. Planning EMIs ensures you do not overburden your co-applicant or yourself. Missing repayments can impact credit scores and lead to penalties.

How to Use an EMI Calculator for Two-Wheeler Loans

Input the desired loan amount, interest rate, and tenure. The tool will instantly show your EMI and total interest payable. Adjust the values until you reach an amount that fits your repayment plan.

Things to Keep in Mind Before Signing the Loan Agreement

Before signing your loan agreement, it’s important to review all terms carefully. This section highlights key points you should understand to avoid future issues:

Interest Rate and Processing Fees

Interest rates vary by lender and co-applicant profile. Students may be charged slightly higher rates due to perceived risk. It is helpful to check if there are any hidden processing charges or insurance add-ons.

Tenure and Repayment Flexibility

Choose a longer tenure if you want lower EMIs. However, remember that longer terms may result in higher overall interest. Keep in mind to ask about part-payment or foreclosure options without penalties.

Late Payment Charges and Prepayment Options

Understand the consequences of missing EMIs. Late fees and penal interest can add up quickly. Also check if you can pay off your loan early without extra charges to save on interest.

Final Thoughts

Getting a two-wheeler loan as a student with no income is possible with careful planning, the right co-applicant, and thoughtful EMI management. A student two-wheeler loan can provide financial freedom when supported by informed decisions, which is why using an EMI calculator for two-wheeler loans is essential. Always borrow within your means and remain financially responsible to secure a stable financial future.

Frequently Asked Questions

1. Can a student apply for a two-wheeler loan without having a job?

Yes, students can apply for a two-wheeler loan without income by adding a financially stable co-applicant who meets the lender’s eligibility and income criteria.

2. What is the role of a guarantor in a student two-wheeler loan?

A guarantor ensures repayment if the student defaults. This reduces the lender’s risk and increases the chances of loan approval for students without income.

3. How does an EMI calculator for two-wheeler loans help students?

The EMI calculator for two-wheeler loans helps students and guarantors plan monthly repayments by estimating EMI based on loan amount, tenure, and interest rate.

4. What documents does a student need to submit for a bike loan?

Students must submit ID proof, student ID or college documents, passport photos, and the co-applicant’s income proof and bank statements.

5. Can I prepay my student two-wheeler loan without extra charges?

Many lenders allow prepayment without penalties. Always check prepayment terms in the agreement before signing your student two-wheeler loan offer.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.