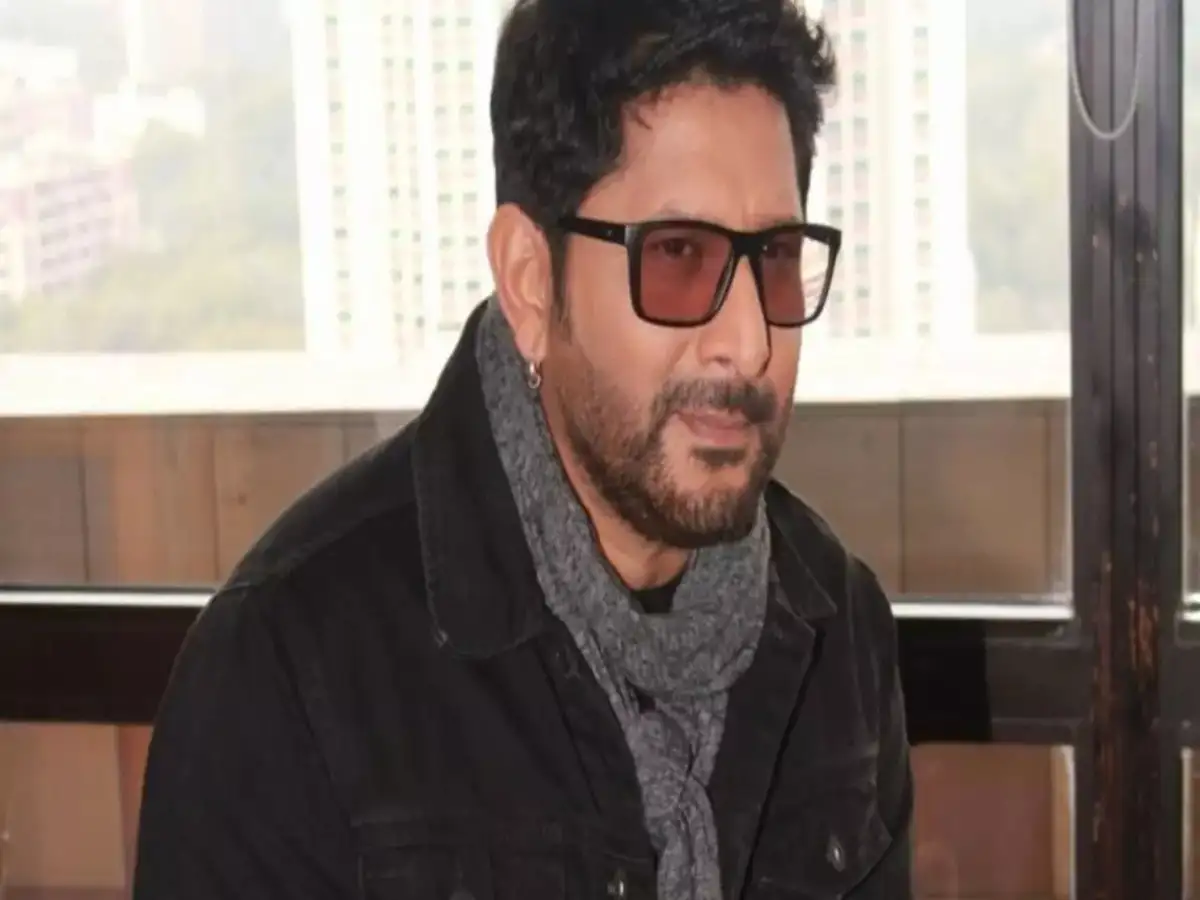

SEBI Imposes One-Year Ban on Arshad Warsi and Maria Goretti

The Securities and Exchange Board of India (SEBI) has imposed a ban on actor Arshad Warsi, his wife Maria Goretti, and 57 other individuals from participating in the securities market for periods ranging from one to five years. This action stems from their involvement in a market manipulation scheme associated with Sadhna Broadcast Ltd, now known as Crystal Business System Ltd. Both Warsi and Goretti have been fined Rs 5 lakh each, while the total unlawful gains from the scheme amount to Rs 58.01 crore.

One-Year Ban for Arshad Warsi and Maria Goretti

According to SEBI’s final order, Arshad Warsi and Maria Goretti are prohibited from trading in the securities market for one year. Each has been fined Rs 5 lakh due to their roles in the manipulation scheme. The investigation revealed that Warsi profited Rs 41.7 lakh, while Goretti earned Rs 50.35 lakh from the illicit activities. In total, 59 entities involved in the scheme have been ordered to jointly repay unlawful gains of Rs 58.01 crore, along with an interest rate of 12% per annum from the conclusion of the investigation until full repayment is made.

Pump-and-Dump Scheme Uncovered

SEBI’s extensive 109-page order outlined a “classic pump-and-dump” strategy executed in two distinct phases. In the first phase, entities linked to the promoters engaged in collusive trading to artificially inflate the stock price of Sadhna Broadcast. This created a false impression of market interest. The second phase involved the release of misleading promotional videos on YouTube channels such as Moneywise, The Advisor, and Profit Yatra, all operated by accused Manish Mishra. These videos coincided with the inflated market activity, allowing the perpetrators to sell their shares at inflated prices.

Key Figures Identified

The investigation identified several key figures behind the scheme, including Gaurav Gupta, Rakesh Kumar Gupta, and Manish Mishra, who were recognized as the masterminds. Subhash Aggarwal served as an intermediary between Mishra and the promoters, while Peeyush Agarwal and Lokesh Shah facilitated the execution of manipulative trades. Jatin Shah was also named as a significant player in the operation. SEBI noted that while some entities did not trade using their own accounts, they acted as information carriers or supported the manipulative trading practices.

Violations and Legal Consequences

All 59 entities involved were found to have violated SEBI’s Prohibition of Fraudulent and Unfair Trade Practices (PFUTP) Regulations. Fines imposed ranged from Rs 5 lakh to Rs 5 crore, and SEBI has initiated steps to recover the ill-gotten gains from the accused parties. Notably, no monetary penalty was imposed on Varun Media Pvt Ltd, a promoter entity, due to ongoing insolvency proceedings. However, the directive for disgorgement remains in effect. SEBI’s investigation began following complaints received between July and September 2022 regarding potential price manipulation and misleading promotional content related to Sadhna Broadcast. A preliminary interim order was issued in March 2023 against 31 entities, including the company’s promoters, leading to the final order that consolidates the findings from the investigation conducted from March 8 to November 30, 2022.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.

Follow Us on Twitter, Instagram, Facebook, & LinkedIn