US Markets Update: S&P 500 and Dow Jones Showcase Investor Sentiment

US markets opened on a mixed note on Thursday as investors remained vigilant regarding the ongoing trade negotiations between the United States and China. Uncertainty surrounding tariff discussions and cautious remarks from key officials have influenced investor sentiment across various asset classes. As of 9:42 AM GMT-4, the S&P 500 showed a slight increase, while the Dow Jones Industrial Average experienced a decline, reflecting the mixed performance of the markets.

Market Performance Overview

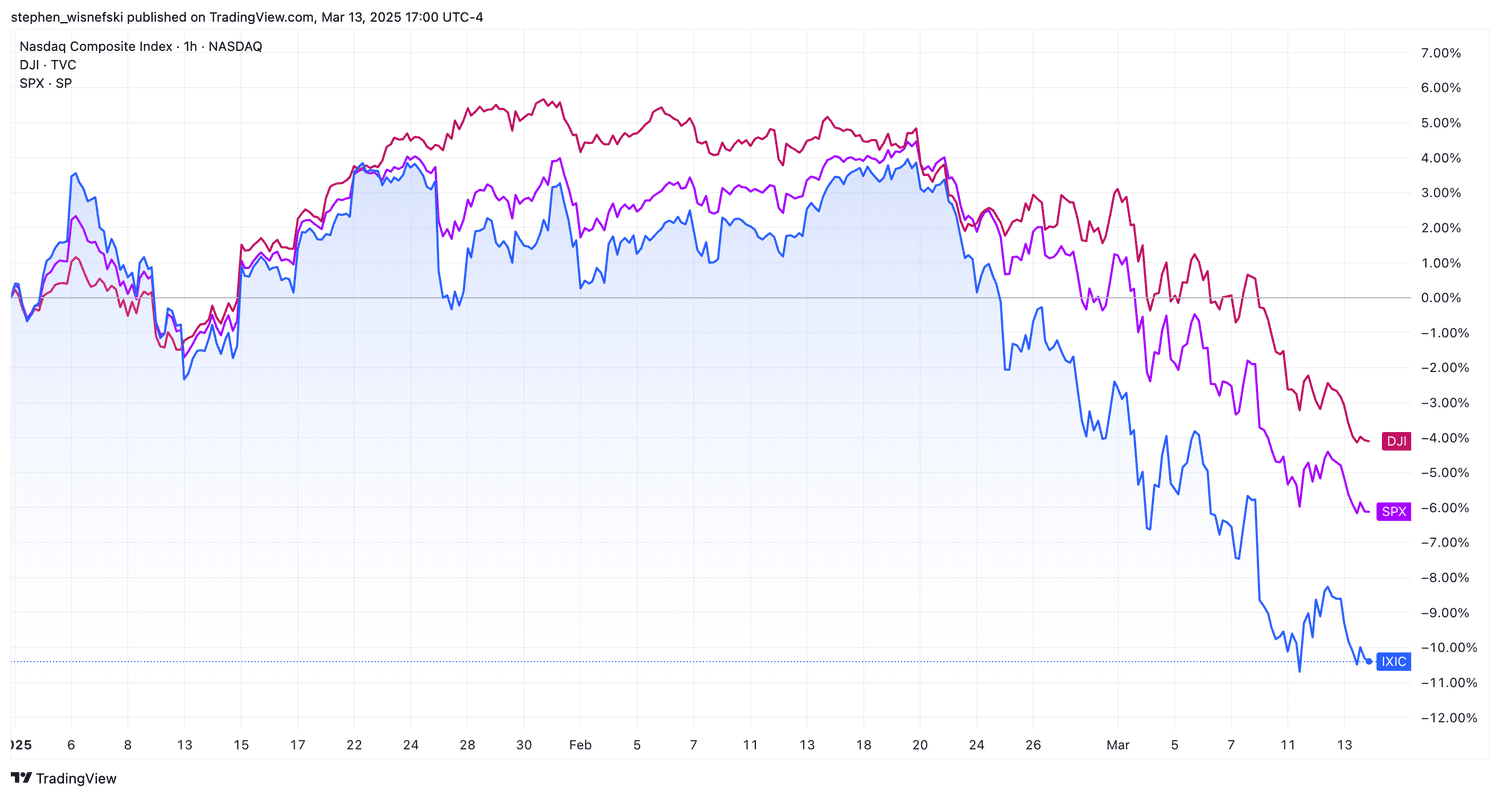

As trading commenced, the S&P 500 index rose by 15.05 points, or 0.28%, reaching 5,390.91. This uptick indicates a degree of cautious optimism among investors. Conversely, the Dow Jones Industrial Average fell by 100.3 points, or 0.25%, settling at 39,506.27. The decline in the Dow was primarily driven by weaknesses in industrial and financial stocks, sectors that are particularly sensitive to global trade dynamics. In contrast, the Nasdaq composite index gained 107.29 points, or 0.64%, climbing to 16,815.34, buoyed by strong performances from major technology companies.

In the commodities market, gold prices increased by $41.10, or 1.25%, reaching $3,335.20. Oil prices also saw a rise, with West Texas Intermediate crude up by $0.58, or 0.93%, at $62.85 per barrel. The yield on the 10-year US Treasury note fell by 5.1 basis points to 4.336%, indicating a shift in investor preference towards safer assets amid the ongoing trade uncertainties.

Trade Negotiations Impact

The mixed market performance comes in the wake of China dismissing optimistic comments made by US President Donald Trump regarding progress in trade negotiations. Trump had suggested that significant reductions in tariffs on Chinese goods were possible and that a “fair deal” with Beijing was within reach. However, Chinese officials labeled these claims as “groundless,” which dampened investor enthusiasm and raised doubts about the likelihood of a resolution to the ongoing trade war.

Adding to the uncertainty, US Treasury Secretary Scott Bessent stated that discussions regarding the reduction of tariffs between the two nations had not yet commenced. This statement has led to increased volatility in the markets, as investors remain cautious and closely monitor developments from the White House. Analysts have noted that the conflicting messages regarding tariffs contribute to market instability, with many investors clinging to every update from government officials.

Global Market Reactions

European stock markets also experienced declines as investors focused on corporate earnings reports for insights into how tariffs might affect business outlooks. The FTSE 100 in London fell by 0.1%, while the CAC 40 in Paris decreased by 0.2%. The DAX in Frankfurt dropped by 0.3%. Analysts noted that comments from business leaders regarding tariffs were prevalent, and investors were eager to understand how companies planned to navigate potential cost pressures.

In Asia, the Nikkei 225 in Tokyo closed 0.5% higher, while the Shanghai Composite ended the day flat. The Hang Seng Index in Hong Kong saw a nearly 1% drop. South Korea’s stock market faced a decline following an unexpected contraction of 0.1% in the country’s economy during the first quarter of 2025. Bessent also addressed US-Japan trade talks, clarifying that there were “absolutely no currency targets,” despite previous remarks from Trump advocating for a stronger yen.

Corporate News Highlights

In corporate news, Japanese automaker Nissan issued a profit warning, raising concerns among investors. Conversely, shares of Nintendo surged by 5.5% due to stronger-than-expected pre-order demand for its upcoming Switch 2 console. In Paris, French software company Dassault Systèmes saw its shares decline by around 7% after reporting a drop in net profit and revising its 2025 operating margin forecast downward. Luxury group Kering also faced challenges, with its Gucci brand continuing to experience a sales slump, leading to a roughly 4% drop in shares.

On a more positive note, French carmaker Renault’s shares rose by approximately 2% after announcing additional cost-cutting measures in response to US tariffs and reporting a slight increase in sales volumes. In Frankfurt, German sportswear manufacturer Adidas saw its shares jump about 3% as its first-quarter profit nearly doubled, exceeding market expectations. These corporate developments reflect the broader impact of trade tensions on various sectors and highlight the ongoing challenges and opportunities within the market landscape.

Observer Voice is the one stop site for National, International news, Sports, Editor’s Choice, Art/culture contents, Quotes and much more. We also cover historical contents. Historical contents includes World History, Indian History, and what happened today. The website also covers Entertainment across the India and World.

Follow Us on Twitter, Instagram, Facebook, & LinkedIn